Neglect maintenance at your peril

Neglect maintenance at your peril

It’s only natural that aircraft owners try to save money on maintenance. That goes double for owners of turbine-powered aircraft, where inspections and overhauls can easily dig deep into five-digit territory. And it’s especially true for individual owner-operators who may not take advantage of a formal maintenance-management system, or simply find that they don’t have the financial clout to keep up with an airplane’s many inspections and other maintenance procedures.

The Asset Insight Index

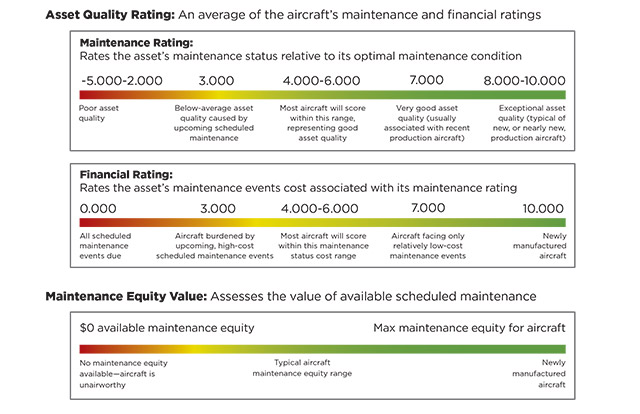

However, any shortcomings in maintenance can bite back big-time when an owner decides to sell or refinance. That’s when an objective look at an airplane’s maintenance status can have a huge impact on asset and market value. How much of an impact? Asset Insight Inc. of Amissville, Virginia, and Vienna, Austria, has developed a proprietary Asset Insight Index algorithm that generates a report on an airplane’s relative maintenance condition, and financial and maintenance equity ratings. Information used in developing the index comes from several main sources. Flight activity and resale market pattern information for comparable airplanes comes from Amstat—a popular market research firm. Assumptions regarding airframe age take flight hours, cycles, and calendar age into account, whichever comes first. (In some cases, an airplane with an older calendar age in compliance with all maintenance requirements may receive a higher rating than a newer one that’s facing a number of required maintenance events.)

Other assumptions include exterior repainting every seven years and interior refurbishment every eight years.

Maintenance details are derived from the average cost of any scheduled maintenance programs established by the manufacturer and the FAA. So are repetitive airworthiness directives and service bulletins. The value of any components with a service life is also factored in, as are the aircraft’s maintenance history and the projected cost of any on-condition component replacements—based on the component’s mean time between failure ratings. Any hourly cost maintenance programs (HCMPs), always helpful in reducing an owner’s cost of maintenance, are also assigned values used to adjust the airplane’s maintenance equity—along with any maintenance tracking data from sources such as CAMP Systems Inc.

The result is a report that objectively quantifies and compares a subject aircraft’s maintenance and financial rating relative to those of comparable fleet ratings, and a review of the fleet ratings themselves. In addition, any aircraft’s individual index can be compared to the average index for comparable aircraft listed for sale.

“It’s the only grading program of its kind,” says Asset Insight President Anthony Kioussis. “Think of it as a credit score for assets. The better an airplane’s maintenance condition, the better its asset index.” At the top end of the index is a new airplane in optimal maintenance condition. At the bottom end is an unairworthy, older airplane with run-out engines, long overdue for many scheduled maintenance procedures.

‘This can’t be right!’

That’s a common exclamation Kioussis hears from many clients who learn that their airplanes aren’t worth as much as they thought. In other words, these airplanes’ maintenance exposures-to-price (ETP) ratios are off the charts. Kioussis says the ETP ratio represents maximum maintenance equity—achieved the day the airplane came off the assembly line—minus the maintenance equity used up by hours, cycles, or time.

“You wouldn’t believe how many owners out there are upside-down because of deferred or substandard maintenance,” Kioussis says. “Many times, these owners can barely afford an airplane, and then they nickel-and-dime their maintenance expenses.” That’s not good for a seller because it means a ton of maintenance expense to bring up the airplane’s value.

Of course, when it comes down to negotiations between a buyer and seller, the subject airplane’s maintenance equity may not be a factor at all if the buyer is smitten with the thought of owning what’s perceived as a coveted design.

Asset management versus multiple prebuys

Why not use prepurchase inspections to determine an airplane’s market value? Kioussis says multiple prebuys can be of value in finding discrepancies and unrecorded or unreported maintenance events. After all, Asset Insights’ reports are not strictly technical evaluations; they are concerned more with the airplane’s financial status in the market at large. Even so, the Asset Insight Index is an equally important assessment tool—and not just for buyers, sellers, brokers or appraisers.

Banks and asset valuation

Banks, which in the future must face the global capital adequacy guidelines set down in the Basel III Accord established by the Basel Committee on Banking Supervision in 2010 and 2011, will find the Asset Insight Index a help. Basel III, designed to ensure capital adequacy sufficient to prevent a relapse of the financial crisis of 2008, requires that if an asset’s market value (sellable price) falls to less than its book value (the price paid for an asset), then the asset’s value must be written down. The only way to bring it up is to put up additional capital—maintenance, in this case—to compensate for the gap. The question is: How much?

At $300 per report, Kioussis’ information is a cost-efficient way for many interested parties to answer the question. Kioussis says he has done 7,000 analyses in 2015 alone. “Fifteen years ago, these sorts of analyses would take two weeks to complete,” he said. “Now, we can do them in two seconds.”

Email [email protected]

Photography by Chris Rose