Aircraft shipments continue slide

Owners, manufacturers eye after-market options

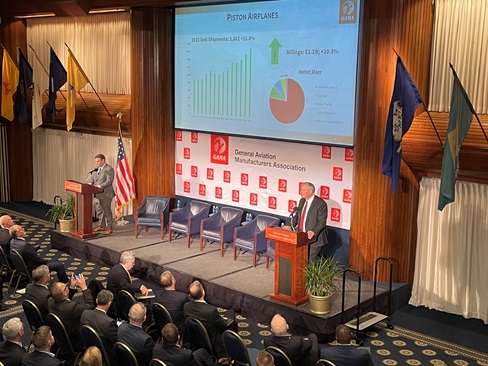

The market’s appetite for new aircraft continues to sour. Numbers released Feb. 22 by the General Aviation Manufacturers Association show total airplane deliveries slipped by 3.9 percent in 2016, compared to 2015. Deliveries of business jets, piston airplanes, and helicopters (both piston and turbine) saw the biggest declines, down 7.9 percent, 4.9 percent, and 16.9 percent, respectively.

Piper Aircraft CEO and GAMA Chairman Simon Caldecott read a litany of decline that affected nearly every market segment to varying degrees, and noted that while shipments fell, revenue actually increased for some segments, and for several companies. Piper, according to GAMA’s spreadsheets, shipped 8 percent fewer airplanes (127, compared to 138 in 2015), but collected 26.8 percent more revenue thanks to a shift from lower-end to higher-priced models. Piper’s M Class models collectively account for nearly half of total aircraft shipped in 2016.

Caldecott said there was “good news” elsewhere in the data, including the 3.4-percent increase in turboprop shipments. Fewer new models hit the market in 2016, compared to 2015, and Caldecott expects 2017 and 2018 will see more new models arrive, particularly as regulators in the United States and overseas reform the certification process. Caldecott said the FAA Part 23 changes will reduce the cost and time required to bring new products to market, and his own company is planning to take advantage once the new rule takes effect in August. That, Caldecott said, “certainly will be good news for our business.”

“We’re planning a series of projects, we’re going to work them under the new regulations so they can get to the market quicker,” Caldecott said, predicting the first would arrive later this year or early next year. Caldecott said the company will look to make new, safety enhancing technology available to the existing fleet as well, through retrofits of many of the same systems being built into production aircraft.

GAMA President and CEO Pete Bunce echoed the sentiment, noting that automation and related technologies being rapidly adopted across many sectors of transportation will find a home in legacy aircraft thanks to the coming changes that will reduce the cost and complexity of adapting modern tools to older aircraft.

“I think this is a springboard for great things to come,” Bunce said.

He also hailed the implementation of BasicMed, though he said he had doubts whether that would alone reverse the decline in the pilot population.

“Where I really see the benefit of third class medical (reform), is we are going to have a much more educated group of pilots,” Bunce said. “Having that recurring training program, and I really applaud our operator, sister associations for putting this in place, because that is going to help save lives.”

Bunce said AOPA and the National Business Aviation Association will be counted on, and collaborated with, as efforts continue to reverse the decline in active, certificated pilots. He said more automated airplanes, with machines assisting human pilots, could contribute to that.

“If you really think about it,” Bunce said, “if, all of a sudden, using technology, aircraft can do things that we used to have to have skill to do before, you’re going to attract young people. No question that young people who look at older aircraft … if it’s got a blank computer screen that looks like a computer in front of them, they get excited. It may not even be turned on.”

There is also, Bunce said, supply and demand, and pilot wages are increasing as air carriers have found it harder to find pilots.

Still, much of the good news was speculative, expectations not yet realized, and while many airplane makers increased revenue despite declining shipments, the helicopter sector suffered on both fronts.

Piston helicopter shipments were down 19.7 percent, and turbine helicopter shipments dropped 15.9 percent, with a 23-percent (combined) decline in helicopter revenue. Caldecott said energy cost fluctuations do much to drive or dampen the turbine rotorcraft market.

Cessna Aircraft, a division of Textron Aviation, saw Skyhawk sales slip sharply, from 143 sold in 2015 to 100 in 2016, though Cessna 182T Skylane shipments increased from 33 to 50, as the company got past a diesel engine debacle that halted Skylane deliveries for months; Cessna had better luck with jets, shipping 178 Citations (all models) compared to 166 in 2015.

Honda Aircraft enjoyed the largest year-over-year increases in the world, at least on a percentage basis, ramping up HondaJet production from 2 in 2015 to 23 in 2016, with billing reported at $4.5 million each.

Cirrus Aircraft announced 2016 was a record year for the Minnesota company. In addition to the first three copies of the new SF50 Vision Jet, the company parachuted 320 SR models to customers in 2016, a 6.3-percent increase that corresponded to a 10-percent increase in revenue.

Gulfstream Aerospace Corp., meanwhile suffered mightily from a shift in the jet market from heavy to light jets. Sales of the Gulfstream 450, 550, 650, and 650ER models slipped from 120 to 88 aircraft, with shipments overall down 25 percent, explaining the 24-percent overall decline in revenue. Gulfstream remains the business jet market leader, however, with $6.2 billion in total revenue in 2016, far ahead of its rivals.

Despite some bright spots, the overall pattern has been dreary for many years, and year-over-year increases modest at best.

“I believe that what we’re seeing today is the norm,” Caldecott said. If one discards certain years with more new model introductions than usual, 2016 fits a longstanding trend. Caldecott said many factors drive the market, and despite the 16-percent decline in business jet revenue, the number is still twice what it was in 2003; small shifts in the number of high-end jets sold have a huge effect on the percentages.

GAMA, which generally advocates for certificated aircraft, doesn’t release numbers on most experimental and light sport aircraft. However, FAA data shows both segments continue to improve. The FAA’s annual forecast shows the total certificated piston-engine fleet decreased by about 3.5 percent over the last four years, while the number of registered experimental aircraft increased by almost 9 percent and LSA increased slightly over the previous five years. The FAA’s forecast calls for a .7-percent decline in piston registrations over the next decade, and a .8-percent increase in experimental aircraft registrations. LSA registrations are expected to increase by more than 5 percent over the same period.