FAA predicts drone growth, stable GA

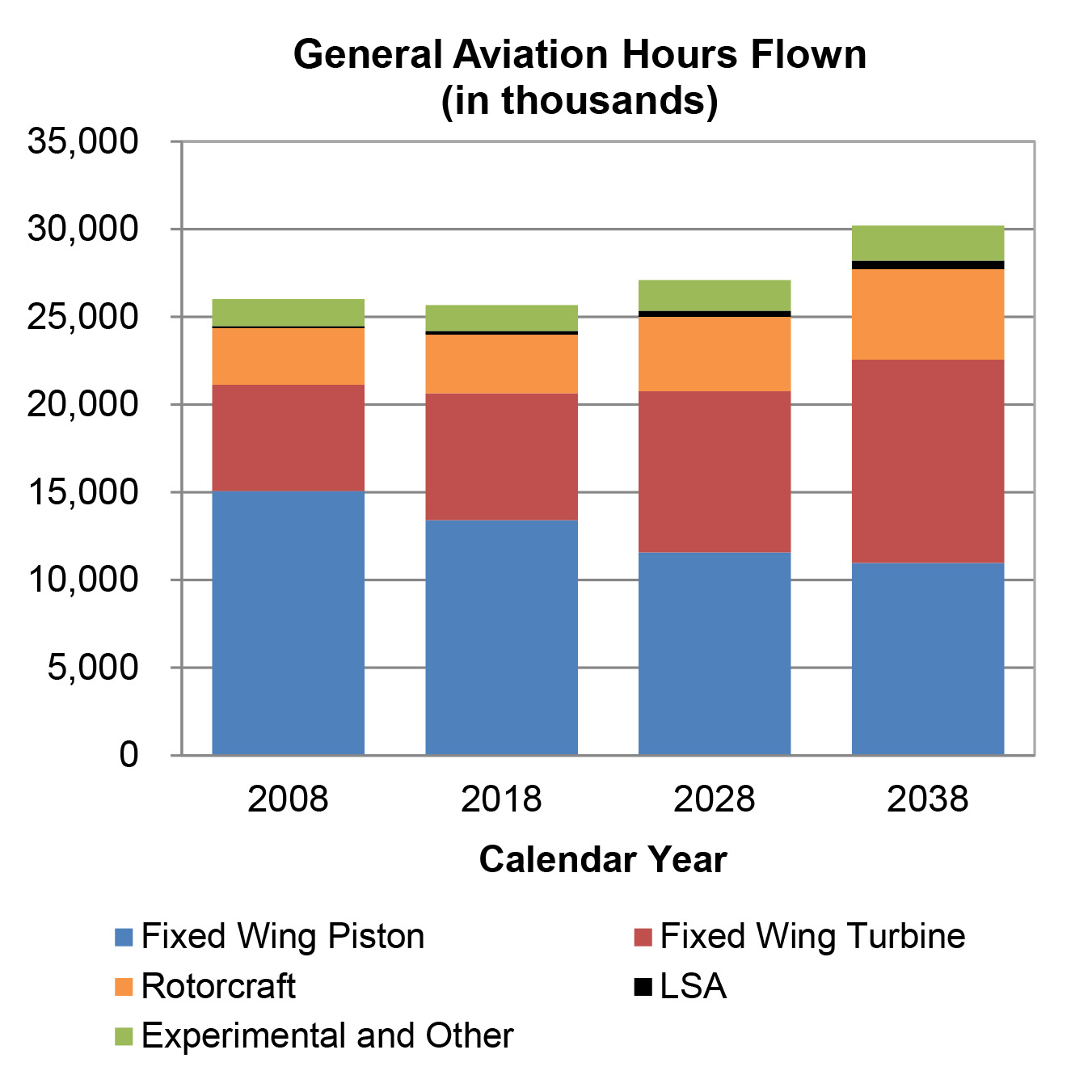

The FAA expects general aviation to remain “stable” by most measures in the coming decades but uses different adjectives when estimating the growth of unmanned aircraft, particularly commercial drones flown under Part 107, for which even the conservative estimate calls for a fourfold increase in five years.

An expected doubling of the size of the light sport aircraft fleet over the coming two decades is among the bright spots for GA in the latest annual update of long-term projections of all types of aviation activity, a forecast that is based on an array of data from many sources, including the FAA’s own, as well as other sources including General Aviation Manufacturers Association shipment and billing data. The agency also consults with a broad range of industry experts.

While the GA fleet size will be little changed overall, the agency expects the piston segment to decline by 22,350 aircraft by 2038.

“Unfavorable pilot demographics, overall increasing cost of aircraft ownership, coupled with new aircraft deliveries not keeping pace with retirements of the aging fleet are the drivers of the decline,” the agency wrote. “On the other hand, the smallest category, light-sport-aircraft, (created in 2005), is forecast to grow by 3.6 percent annually, adding about 2,850 new aircraft by 2038, more than doubling its 2016 fleet size.”

The latest forecast marks the second year that the FAA has predicted unmanned aircraft activity, and that document reads much like the first, still calling for dramatic growth in the population of remote pilots certificated under Part 107, along with unmanned aircraft registered to operate under Part 107, with roughly fourfold increases for both projected—not in 20 years, but in five.

Drone hobbyists are not required to register individual aircraft. Registering as an individual (a requirement that was reinstated in December after new federal legislation re-established the agency’s prerogative to require hobbyists to register) allows hobbyists to fly any number of aircraft under a single number, so the precise number of drones being flown for non-commercial purposes under the model aircraft rule is not known. The FAA previously projected that more than 1 million of these hobby drones (model aircraft) would be active by the end of 2016, but now believes that the actual number was around 788,570, 28 percent below that previous projection. Comparing 2016 and 2017 data still suggests an annual growth rate for hobbyist drones of around 40 percent.

“However, the trend is likely to slow as the pace of falling prices slow and early adopters begin to experience limits to their experiments,” the agency wrote. By 2022, FAA estimates of the total model aircraft fleet range from 1.96 million to 3.17 million.

On the Part 107 side, the FAA notes that growth will be predicated in large part on factors still unknown, particularly use cases that are being sought by industry but not yet allowed, such as flights beyond visual line of sight.

“If, for example, professional grade UAS meet feasibility criteria of operations, safety, regulations, and economics/business, and they enter into the logistics chain via delivery of small packages, the growth in this sector will likely be phenomenal,” the agency wrote. “In a similar vein, the Low Altitude Authorization and Notification Capability (LAANC), which began testing in 2017 and is planned to be rolled out nationally over this year, is designed to allow considerable flexibility in UAS operations and facilitate non-modelers’ use of the NAS.”

The potential for commercial drone growth is difficult to predict with precision, and predicated on rule changes and implementations not yet realized.

“As non-model aircraft become operationally more efficient and safe, battery life expands, and regulatory constraints are reduced, new business models will begin to develop, thus enhancing robust supply-side responses. These responses, in turn, will pull demand forces (e.g. consumer response to receiving commercial packages, routine blood delivery to hospitals, etc.) that are presently latent,” the FAA wrote.

The projections for remote pilot certifications are based in large part on the projected growth in the commercial drone fleet, with the FAA estimating the industry will need one pilot for every 1.5 commercial drones.

The data also reflects a relatively low bar of entry for remote pilots, compared to certification to fly manned aircraft. Remote pilots certificated under Part 107 have to date posted a 90-percent pass rate on the written exam (there is no practical test required). Nearly all of these are presumably aviation newcomers, as the knowledge test is not required for those seeking remote pilot certificates who hold already hold other pilot certificates, other than student pilots, with a current flight review.

The FAA issued 73,673 remote pilot certificates by the end of 2017, and expects that number to increase to 301,200 by 2022, “ providing tremendous opportunities for growth in employment associated with commercial activities of the UAS.”

The FAA has granted more than 1,600 waivers to operators seeking to expand the limits of Part 107, 86 percent of those allowing operations at night. Nearly 13,000 airspace authorizations and waivers had been issued by the end of 2017, nearly half of these for operations in Class D airspace, though waivers and authorizations to operate in Class B, C, and E airspace are also becoming more common.