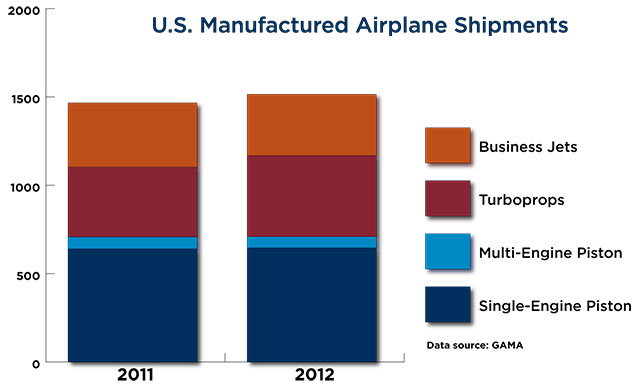

The General Aviation Manufacturers Association (GAMA) released its annual report on shipments of new general aviation aircraft, and the news for 2012 was “mixed” according to Brad Mottier, GAMA’s 2013 chairman of the board. The worldwide total number of aircraft shipped in 2012 (including helicopters, the sales of which were reported for the first time this year) was posted as 3,177 units worth almost $22 billion; fixed-wing aircraft delivered by U.S. manufacturers totaled 1,514 units.

Compared to 2,979 aircraft delivered in 2011, 2012’s numbers were up by 198 aircraft, according to the data released by GAMA.

In an important development over the past year, GAMA has begun to include rotorcraft and turboprop-powered agplanes. Both categories boosted the shipment numbers, and Bunce said that without the representation of these new categories deliveries would have otherwise been “flat.” Year-end airplane shipments increased 0.6 percent to 2,133 airplane deliveries in 2012, GAMA said.

However, the 2012 turboprop-airplane category jumped 10.3 percent from 2011 to 2012 thanks to the inclusion of 169 airplanes manufactured by Air Tractor and 51 airplanes manufactured by Thrush Aircraft Inc. (For comparison, GAMA also this week issued revised numbers for 2011 that include the agricultural turboprops.) These two companies account for the entire net increase in turboprop sales, according to GAMA data.

The 1,044 helicopters—214 of them turboprop-powered—delivered by Robinson Helicopter Company upped that category by 21.5 percent over 2011’s numbers. GAMA also said it was contemplating adding more light sport aircraft; companies such as Flight Design are already in the current accounting.

Apart from these new categories, worldwide piston airplane deliveries sank from 898 units in 2011 to 881 units in 2012, a drop of 1.9 percent.

Meanwhile, worldwide business jet deliveries dropped from 696 to 672 airplanes, for a decline of 3.4 percent. While this was a mere handful fewer than the 680 to 720 2012 business jet deliveries predicted by Honeywell’s Business Aviation Forecast issued last October, it represented a continuation of the cautious trend among general aviation buyers of turbine airplanes. Honeywell had predicted that 30 percent of corporate flight departments had plans to buy or replace one or more business jets by 2017. If correct, that trend appears to be late in starting.

Factors working against a more vigorous recovery of general aviation aircraft sales include continued economic uncertainty, fears of a downward correction in the stock market, and the fact that more than 12 percent of the business jet fleet is up for sale in the used market. With more good, used, undervalued jets in play there’s less inclination for customers to buy new.

One business jet manufacturing executive said that political events have also taken a toll, citing a prospect’s decision to walk away from a purchase after Syrian defense forces shot down a Turkish fighter last June.

“While the 2012 shipment and billing data were mixed, the numbers don’t reflect the amount of development work in progress in general aviation,” said Mottier. “The general aviation segment is poised for resurgence in the next few years as these new technologies certify and enter the market.”