Used aircraft values still dropping

Great expectations are diminished by harsh reality

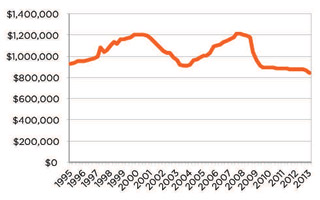

That’s not true with the Vref turboprop index, which took another plunge in the first quarter of 2013. The average price began a vertical dive in the third quarter of 2008 from $1.18 million, leveled off a little at $893,330 in 2009, dribbled downward but then plunged from $868,000 to $841,670 in the first quarter of 2013. Vref does not break down turboprops according to size. A quick scan of several models and years of the Beech King Air show rapid declines in value.

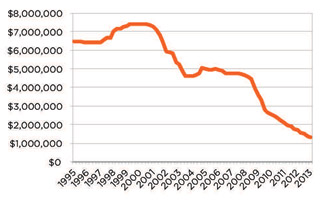

It does do that for jets, however. Light jets were discussed above. Mid-size jets, like most other categories, rose with the dot-com industry, fell with it, recovered, and fell with the housing and mortgage recession—then just kept on dribbling down. The index starts in 1994 at $6.47 million, reaches a high of $7.42 million, drops dramatically in the third quarter of 2008, and today stands at $1.3 million.

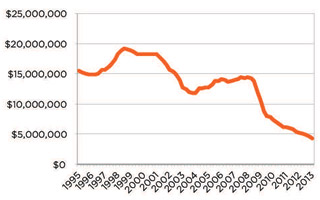

Large jets start on the Vref charts at $15.4 million, went as high as $19.16 million in 1998, fell to $11.72 million in 2003, but recovered to $14.4 million in 2007—then plunged in the third quarter of 2008, slowed the rate of decline somewhat in 2009, and today stand at $14.25 million.

The same trend is true for pressurized piston twins and single-engine piston aircraft. The complex single index includes the Beechcraft Sierra, the Bonanza A36, the Cessna 177RG, the Cessna 182 and 210N, the Mooney M20M, and the Piper Arrow and Saratoga SP. It shows a steady appreciation in value from 1994 ($135,750) to 2001 ($171,870), then a slide followed by a vertical drop in the line chart starting in 2006, ending up at $113,630 in 2009. Following that there was a bounce upward to $120,750 in 2011 but now prices have declined and are leveling at $118,130 for the first quarter of 2013.

Owners of most models seem to remember the years of appreciation, but don’t appreciate that those were followed by years of dramatic depreciation. Those who report the value of used aircraft bear the brunt of their wrath.

Email [email protected].

Illustration by Neil Webb

Cars depreciate dramatically as they are driven off the dealer’s lot and house values drop with the economy, but aircraft historically have not only kept their value, they sometimes exceeded it. Owners got used to the expectation of appreciation and bragged about it. A new reality has come to town. Charts from Vref, the aircraft value reporting service, indicate prices of most aircraft of any type in the general aviation fleet have dropped dramatically since the recession. At the time this was written, most were still declining.

Aerospace analyst Brian Foley warns that such an assumption is too broad. There must be a few models of aircraft climbing despite the economy, right? “I can’t think of any that are going up,” said Vref President Fletcher Aldredge. (Owners need to remember that Vref reports what happened in recent sales; the firm doesn’t set aircraft values.)

Foley said the charts a year from now will show an upward trend, and that aircraft have finally hit bottom. That’s what Aldredge thought in 2011, but he did see a hint of optimism during the course of a few days when this article was prepared. In early March, the unemployment figures dropped and hiring rose. “I’m more optimistic,” Aldredge said, edging closer to the position staked out by Foley.

For now, the reality is that aircraft values are finding new lows every quarter. It doesn’t matter if you own a jet, a turboprop, or a piston-engine airplane; the value is going down. The only exceptions, Aldredge said, are fairly new aircraft sitting in a hangar flying very little. Those aircraft are in demand, making them worth more.

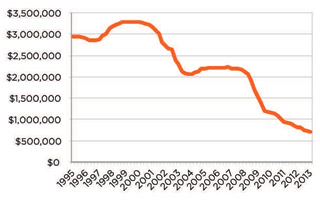

Aldredge combines several similar models and tracks them from 1995 to the present. He also tracks aircraft individually. For example, that Cessna Mustang you bought in 2011 for $3.15 million is now worth $2.5 million. Most light jets in general, to include the Beechjet 400A, the Cessna CitationJet, the Citation II, the Falcon 10, the Westwind II, and the Learjet 31A, went down. The index starts at $2.95 million in 1995 and drops to $699,000 for the first quarter of 2013. Normally aircraft prices fall and rise with the economy, but prices plunged as if off a cliff starting in 2008. Now the vertical drop of the chart lines has leveled some, but continues to dribble downward.

What about the 172?

Prices of a Cessna 172 made in 1986, the last year of production before an 11-year hiatus, are continuing to depreciate. Those made in 1997 or later have at least bounced off the bottom and are holding steady. Let’s pick a Cessna 172 at random—say, a 1974 M model. Owners could say their aircraft was worth $32,000 in 1995, and that it appreciated steadily to $45,000 in 2001, dropped slightly, and resumed the appreciation to $47,000 in 2005. The vertical dive came in 2006 that ended at $38,000 in 2007, recovered to $39,000 in 2010, but today stands at $36,000.

Lenders are spooked

The airplane market has been analogous to the housing market over the past few years, said aerospace analyst Brian Foley. Although values are low today, it wasn’t more than five or six years ago that residual values were more like 100 or 120 percent of new, he said. Cash was readily available, new models were coming forward, the economy was perking. Buyers of new aircraft were paying tens of millions just to purchase a slot in the production line so delivery would occur sooner. That resulted in overpaying for jets. Homebuyers were overbidding for homes to get ahead of others in line. In 2009 that all changed. “Pretty much everyone ran for the exits,” Foley said.

“We see some stability in the economy, but people aren’t rushing out to buy airplanes just yet,” he said. They need confidence in the economy. “I’m confident that if things keep progressing economically the way they are, we’ll see pre-owned prices start to get traction again. They’re not going to rocket up to the 2007 or 2008 levels.

“In the heady days of 2007 and 2008 when there was lots of capital to be had, a buyer could put zero percent down, use the airplane as an asset, and your credit worthiness wasn’t of so much interest to the lender. They knew they could always come and take your plane. Today the demand is going to be capped a little bit. A buyer would most likely put 10 to 15 percent down.”

VREF TURBOPROP INDEX

A compilation of the Beechcraft King Air C90A, the B200, the Cessna Conquest I and II, the Piper Cheyenne II, and the Twin Commander 690B.

VREF MID-SIZE JET INDEX

A compilation of the Cessna Citation III, Citation VII, Gulfstream Astra SP, Hawker 800A, and the Learjet 60.

VREF LIGHT JET INDEX

A compilation of Beechjet 400A Cessna CitationJet, Citation II, Citation V, Falcon 10, Westwind II, and Learjet 31A.

VREF LARGE JET INDEX

A compilation of the Bombardier Challenger 601-3A, the Falcon 50, the Falcon 900, and the Gulfstream IV.