JETNET forecasts bizjet trends

Optimism rises with vaccine news

In a press conference at the National Business Aviation Association’s GO Virtual Business Aviation Convention and Exhibition, market intelligence experts at JETNET iQ reviewed its poll of 20,000 business aircraft owners from 135 nations to come up with purchasing projections ranging from 2020 to 2029.

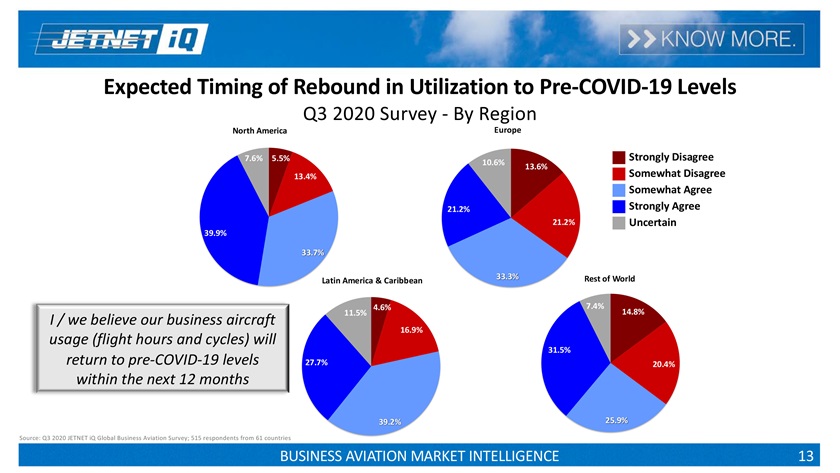

As for a return to pre-pandemic flight activity in the next 12 months, 39.9 percent of North American respondents strongly agreed that flying would recover. In Europe, 21.2 percent agreed with that statement. In Latin America, 27.7 percent agreed, and so did the rest of the world at 31.5 percent. Disagreement scores ranked from a high of 35 percent to North America’s 19 percent.

For those worried that COVID-19 would allow Zoom-like virtual meetings to rob business aviation’s ability to enable face-to-face meetings, JETNET also came up with data. But in this area, majorities in all but North America agreed that Zoom/Teams/Skype virtual meetings are just as effective as the real thing.

As for purchase intentions in a post-pandemic world, small jets came up strong, with 40.1 percent of respondents saying small-jet sales would increase. Large jet sales were predicted to decrease by 42.6 percent.

In surveys taken from Q4 2019 through Q3 2020, JETNET found that Pilatus’ new PC–24 won a popularity contest, with 9.7 percent saying they were most interested in buying it next, closely followed by Gulfstream’s upcoming G700 at 8.4 percent. Gulfstream’s G600 came in at 3.7 percent.

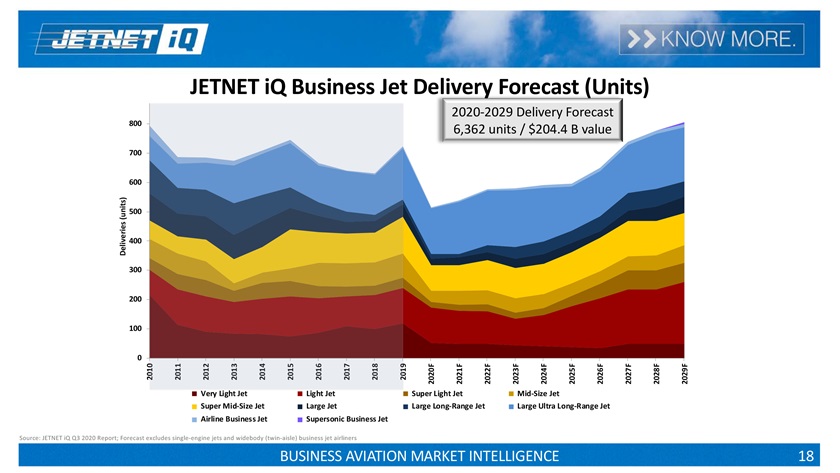

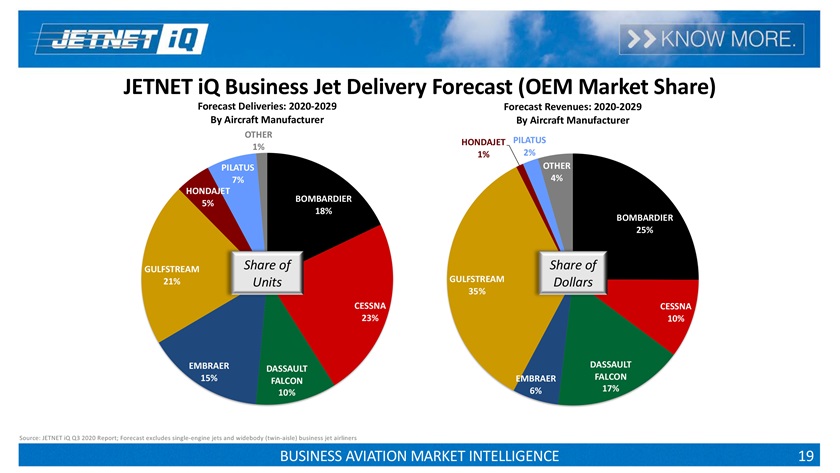

After 2020’s drop in deliveries, JETNET expects sales to rise to 6,362 aircraft worth $204.4 billion by 2029, with Cessna and Gulfstream taking the biggest share of deliveries.

JETNET iQ creator and director Rollie Vincent said that the COVID-19 crisis had made charter flying stronger, that he was bullish on fractionals, and that there would be an “insatiable” demand for upcoming supersonic business jets. “I haven’t seen such enthusiasm in 15 years,” he remarked.