Using an HSA as a Retirement Account

Did you know HSAs have triple tax efficiency? An HSA may be the most powerful wealth-accumulation tool available to you. Discover how you can use an HSA to support your retirement savings goal.

There are few vehicles as tax efficient as a health savings account (HSA). I like to think of HSAs as a ROTH on steroids. In most cases[1], with a ROTH account you can invest after-tax dollars that grow tax-free and are withdrawn tax-free in retirement. With an HSA, you can deposit pre-tax dollars that grow tax-free and when withdrawn for qualified medical expenses (QMEs) are distributed tax-free.

HSA account rules

To contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP) and cannot be covered by any other traditional health plan. Contribution limits for HSA accounts are indexed for inflation and for 2020, the limit is $3,550 for an individual and $7,100 for an employee with family coverage. If you are 55 or older, you are allowed an additional $1,000 as a catch-up contribution.

HSA contributions are not subject to federal income tax, state tax (except in AL, CA and NJ), or FICA taxes if made through your employer’s HSA plan.

HSA distributions are tax-free if used for QMEs of your own, your spouse, or anyone who is a dependent on your federal tax return. Your HDHP premium is not a QME because you are already using pre-tax dollars.

Reimbursement for a QME from an HSA does not need to be taken in the year the expense was incurred, but the QME must have occurred in a year you were covered by an HDHP and you did not receive a tax deduction for the expense.

Unlike an FSA, an HSA does not have a use-it-or-lose-it provision. The money you contribute is yours until you use it and becomes part of your estate if you were to pass. You don’t need to submit “proof” of a QME to make a withdrawal, just save the QME receipts in case you are ever audited by the IRS. You can also change your HSA contribution rate throughout the year.

Contributions to an HSA stop once you go on Medicare Part A, but withdrawals can continue.

“What should I contribute to first?”

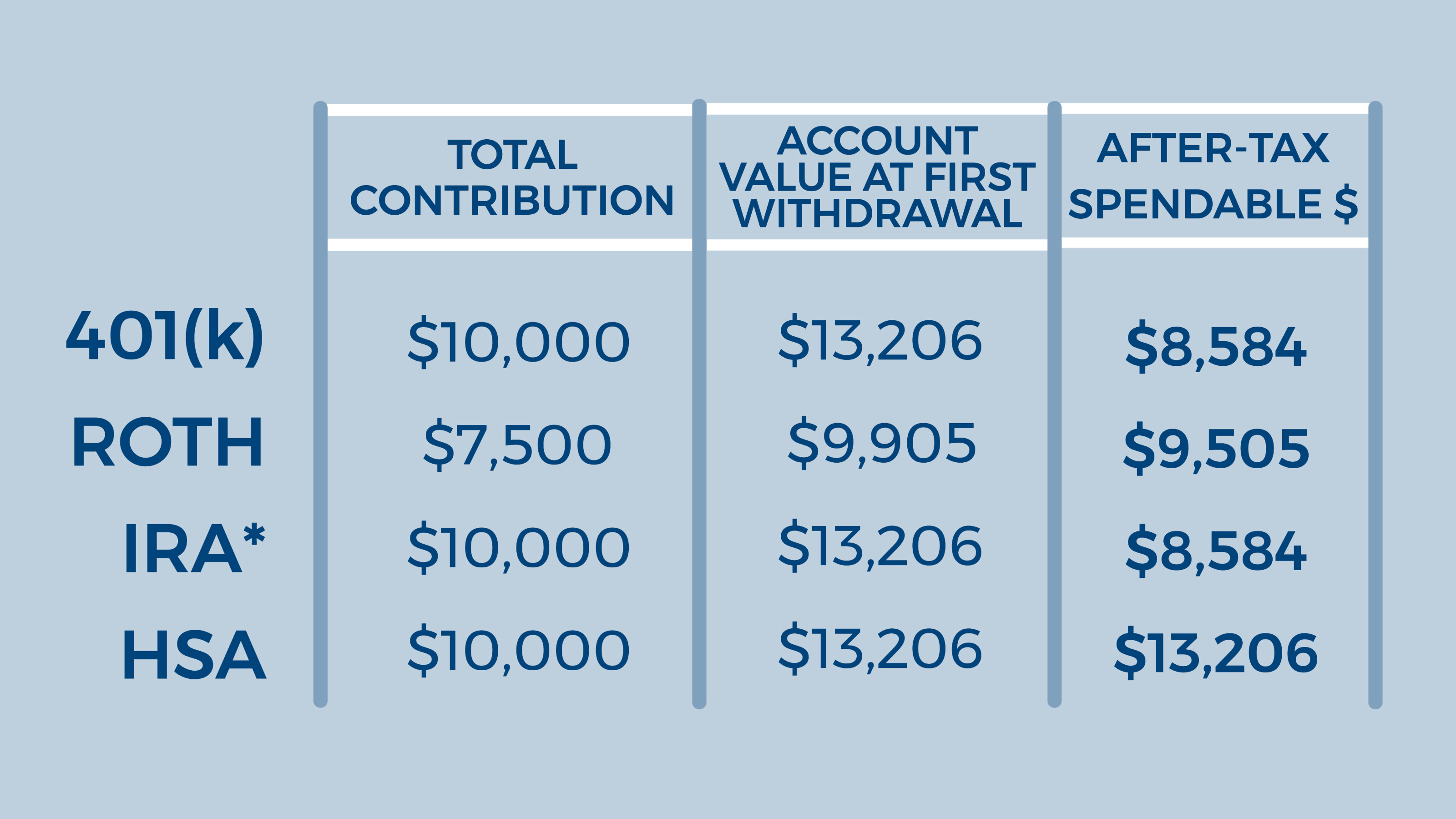

Let’s take a quick look at the tax treatment of these different accounts.

Spendable dollars in the future

I will use the following assumptions:

- 25 percent effective tax rate.

- 5 percent annualized growth.

- $1,000 yearly contribution.

- 10 years from first contribution to first withdrawal.

- No company match to your 401(k).

An HSA can yield over 30 percent more in spendable dollars than any other savings vehicles.

If you currently aren’t in a position to contribute the maximum allowable to your 401(k) and an HSA, I would recommend that you contribute enough to your 401(k) to receive the full company match and then contribute as much as you can to an HSA. As your income rises and you have excess cash flow, contribute the maximum allowable amount to your HSA, then increase your contributions to your 401(k) with the goal of maxing out your contribution.

Here is the priority for retirement savings:

- 401(k) contributions sufficient to capture all of your company match.

- HSA.

- 529 plan contributions (if needed).

- Unmatched contribution to retirement savings plan (401(k), IRA).

Fidelity estimates that a couple retiring in 2019 at age 65 will incur $285,000 in medical expenses in their lifetime², not including any costs for long-term care. An HSA is the only current vehicle that allows you to save pre-tax dollars, invest them, watch them grow tax-free, and withdraw them tax-free to pay medical expenses.

Please remember that the following recommendations are somewhat generic using assumptions on earnings and tax brackets. For recommendations specific to your situation, please contact your financial advisor.

[1] ROTH contributions are income-dependent. Consult your tax professional for specific advice.

[2] According to an article published by Fidelity Investments in April 2019 titled, “How to plan for rising health care costs.”

*For the purposes of this discussion, we will assume you are below the income limits that would otherwise exclude you from making these contributions. Source: Geisler, G. Ph.D. (2016). “Could a Health Savings Account Be Better than an Employer-Matched 401(k)?” Journal of Financial Planning 29 (1): 40 – 48.

Gary Krasnov | Chief Compliance Officer & Vice President of Airline Strategy

Gary Krasnov serves as the Chief Compliance Officer and Vice President of Airline Strategy for RAA. Gary joined RAA in 2016 as part of the Advisor Financial Services merger where he was a Partner and CCO. He is responsible for firm compliance with all SEC and DOL laws and regulations.

Gary is also a recently retired Delta pilot and flew as an international B-777 Captain. Prior to Delta, Gary flew in the U.S. Navy and retired as a Commander from the Navy Reserves. He graduated from the University of New Hampshire with a degree in Economics and is an Accredited Investment Fiduciary (AIF®).