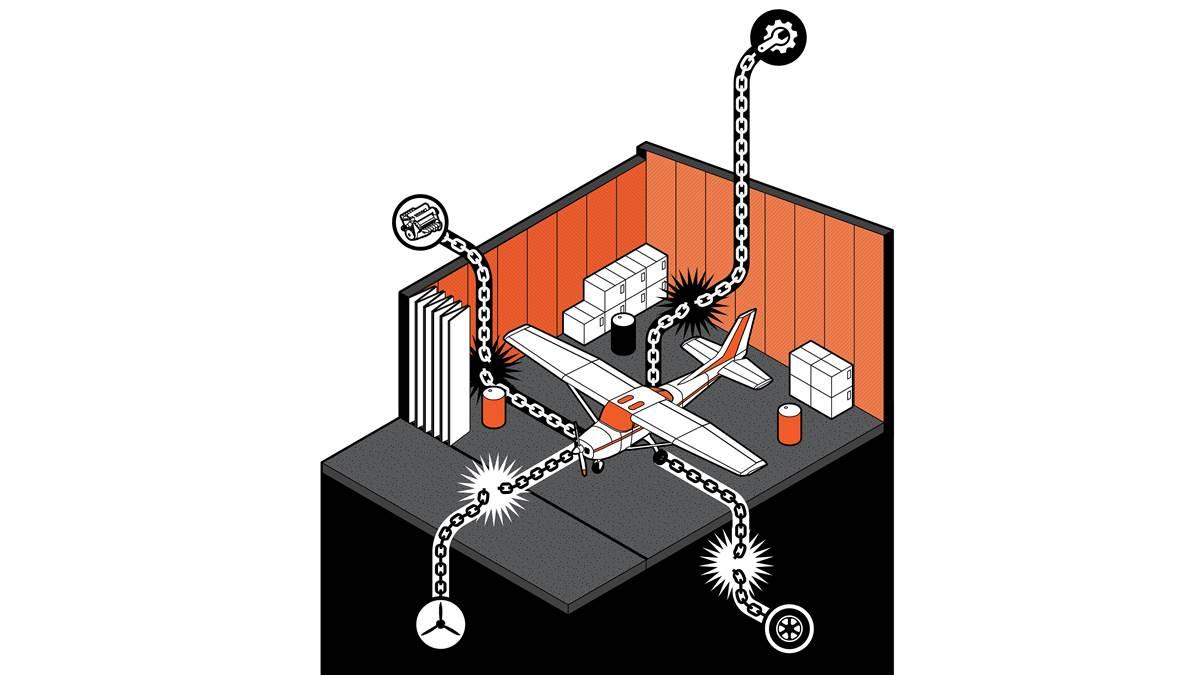

Weakest link

Supply chain problems continue

Overhaul shops were quoting turnaround times of four to six months, and some wouldn’t even touch our slightly unusual Continental IO-360-KB. With about seven months until our reliable engine timed out, we swallowed hard, threw a bunch of money at Air Power for a new engine from the manufacturer, and hoped the promised six-month wait would materialize. Imagine our relief—and frankly, surprise—when the email came saying it was ready almost exactly on time.

Overhaul shops were quoting turnaround times of four to six months, and some wouldn’t even touch our slightly unusual Continental IO-360-KB. With about seven months until our reliable engine timed out, we swallowed hard, threw a bunch of money at Air Power for a new engine from the manufacturer, and hoped the promised six-month wait would materialize. Imagine our relief—and frankly, surprise—when the email came saying it was ready almost exactly on time.

Such is the wonderful world of aircraft ownership in the era of broken supply chains. Bought a tire, battery, or an oil filter lately? These common replacement parts are just a few of the thousands of nuts, bolts, glue, and microchips that have arrived late—or worse, never—to aviation manufacturers around the world. While we most feel the anxiety at every oil change and annual inspection, the pain extends across every facet of aviation, from component suppliers to avionics and aircraft manufacturers.

What began during the many pandemic-related lockdowns has now become a systemic problem that is a perfect storm of explosive demand, labor shortages caused in part by early retirements, and shortages of raw materials. It extends across the entire supply chain. A popular aircraft manufacturer told AOPA that it would ship more airplanes if it could get more propellers. The propeller manufacturer would ship more propellers if it could get the glue used during the composite manufacturing process. And the glue supplier would make more glue if it could get a critical chemical.

Issues like these are popping up routinely for manufacturers. And we need look no further than their current strategies to understand just how challenging the environment is. The goal isn’t necessarily full recovery—it’s managing the worst of it.

When the grocery store is out of your favorite cereal, you just head to the next one down the street. Why can't Textron or Garmin or Champion do the same?Continental came through exactly as promised on our engine, which is a major part of the company’s supply chain strategy. In a statement, a company representative said, “Throughout this process, the Continental team has stepped up their efforts to create additional flexibility within the supply chain, communicate areas of impact to the production schedule, and better manage customer expectations.”

Flexibility is the one of the most frustrating parts about the shortage for owners and suppliers. When the grocery store is out of your favorite cereal, you just head to the next one down the street. So why can’t Textron or Garmin or Champion do the same? “Manufacturers are required to have full understanding of their supply chain,” said Jens Hennig, the General Aviation Manufacturers Association’s vice president of operations. “As part of their FAR Part 21 responsibilities they have to get several levels into that process.” Which means that even if a manufacturer could find another supplier capable of making the part—and that’s a big if in aerospace—the time it would take to get that supplier onboarded and up to speed is probably longer than the delay from the original supplier.

Then there’s the FAA. “Switching from one lightbulb to another isn’t something a manufacturer can do by themselves,” Hennig said. “The FAA has to be in a position to work with the manufacturer to be sure that it is permissible.” And, you guessed it, the FAA has its own labor shortage issues. Suppliers will shut down or get out of the aerospace business, and that usually necessitates a change, but otherwise, manufacturers tend to stick to the known quantity. Hennig said aerospace has historically been built on long-term relationships and contracts in the interest of stability, giving the impression that the culture hasn’t been easy to overcome.

Many manufacturers now have teams in place dedicated to solving the issues as they pop up.So, management becomes the only solution. Many manufacturers now have teams in place dedicated to solving the issues as they pop up. These teams are active participants in the supply process, whereas before they would often just wait for a delivery to show up, trusting it would happen as promised.

The Continental representative said, “Our supply chain team has done a great job working with suppliers to work through their challenges which range from labor to raw material shortages. The issues, surrounding circumstances, and the scope of impact can rapidly change and escalate making it imperative for our team to think of innovate solutions.”

None of this speaks highly of future relief, and in fact, the challenges will likely remain for the near to mid future. Hennig points to systemic challenges with the labor market. Look at the 2020 U.S. Census, he said. “The peak boomer retirement, we’re right in the midst of it.” In terms of materials, no doubt China abandoning its zero COVID policy will mean new waves of transmission and a shortage of production as well.

AOPA published a story about the supply chain challenges last summer, and in it, Garmin’s Jim Alpiser said that times were coming down, and in many cases they were shorter than the shop wait times. In providing an update for this story he said, “The impact of the supply chain challenges is still being felt; however we are seeing improvements continue for most products. Several previously constrained products are in stock, and we expect to continue to see improvements in the coming weeks and months.”

Our airplane also needs a new ADS-B transponder. Wait time for the GTX 335? Seven months.

Challenges, indeed.