American Capital, based in Bethesda, Maryland, has sold a 100-percent stake in Piper Aircraft to Imprimis, an investment strategy company with offices in Bangkok, Singapore, and a new office opened in Brunei Darussalam in 2008.

American Capital, based in Bethesda, Maryland, has sold a 100-percent stake in Piper Aircraft to Imprimis, an investment strategy company with offices in Bangkok, Singapore, and a new office opened in Brunei Darussalam in 2008.

Piper spokesman Mark Miller said the move represents a significant capital investment for Piper, and added the new owner is committed to the PiperJet. He called Imprimis a large fund that thinks strategically. “Imprimis’ commitment to Piper gives us the resources we need to fulfill our goals,” Miller said.

American Capital purchased Piper in June 2003 and was then called American Capital Strategies. It purchased $57 million of the then-New Piper’s senior debt for $34 million, and exchanged $22 million of it for equity. American Capital buys companies, improves their profitability, and sells them. The firm said recently it had stopped most negotiations because buyers assumed all properties were discounted due to the economic downturn.

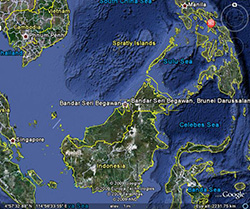

Location of Imprimis-led investment fund that owns Piper Aircraft. Photo: Google Earth.

Location of Imprimis-led investment fund that owns Piper Aircraft. Photo: Google Earth.

Imprimis opened its Brunei office in 2008, the same year that Imprimis signed an investment strategy contract with the Brunei Ministry of Finance. The government formalized an agreement for setting up a private equity fund to be invested domestically. Imprimis (B) Sdn Bhd, an Imprimis subsidiary, is the manager of the Imprimis Strategic Investment Corporation (NBD) Sdn Bhd, an investment company that seeks to invest in companies that can contribute to the long-term diversification of the Brunei economy. Piper will seek long-term growth in the Asia market.

The Piper headquarters will remain in Vero Beach, Fla.

“Imprimis brings a level of support that will propel Piper from its current status as a company with a strong heritage, track record of innovation and great potential to one that is growing and pushing the envelope within General Aviation,” said Piper President and CEO James K. Bass. “Imprimis’ commitment to grow Piper in both existing and emerging markets comes at a time when we are poised to enter a new era in aviation history.”

John Foster, president of Skytech, one of Piper’s largest dealers, said he was very enthusiastic about the cash infusion and Imprimis’ ability to provide in roads for Piper in the emerging Asian aviation market. “American Capital’s motivation was not to enhance the aviation industry. It was a financial investment for them. Imprimis has both a financial and a strategic interest in improving aviation.” The Asian market, he said will continue to develop. “Aviation is a world market. He who gets in on the bottom floor in Asia early wins. That’s where you want to be.”

Imprimis Managing Partner Stephen W. Berger pointed to Piper’s substantial track record and respect the company enjoys within the general aviation industry as being among the primary reasons to acquire Piper.

“Piper’s capabilities, its excellent dealer family and extensive customer base, coupled with Imprimis’ capability to provide financial support, our dedication to growing the companies we invest in, and our contacts within Asia provide fertile ground for Piper to expand its business in the Asian market and throughout the world,” said Berger.

Aerospace analyst Richard L. Aboulafia said the switch in owners is merely “going from one equity firm to another. It doesn’t change the fundamentals. It’s a tough market and Piper has a difficult product portfolio. The PiperJet market is tough on newcomers.”