Will we all be flying diesels?

The revolution is mostly outside the United States

Related Articles

Our editors explore the future of general aviation propulsion technologies

I was at the Paris Air Show when Renault—working with Socata—announced a plan to develop a new diesel engine for general aviation. In the intervening 15 years or so, the road to diesel acceptance has been long and winding, but it feels as if we’re on the cusp of a significant broadening of propulsion options for general aviation; a tipping point, if you will. Driven in part by the process to eliminate leaded avgas, but more so by the high price of avgas and the relative low price of Jet A in most countries, diesel options are both expanding and becoming more accepted.

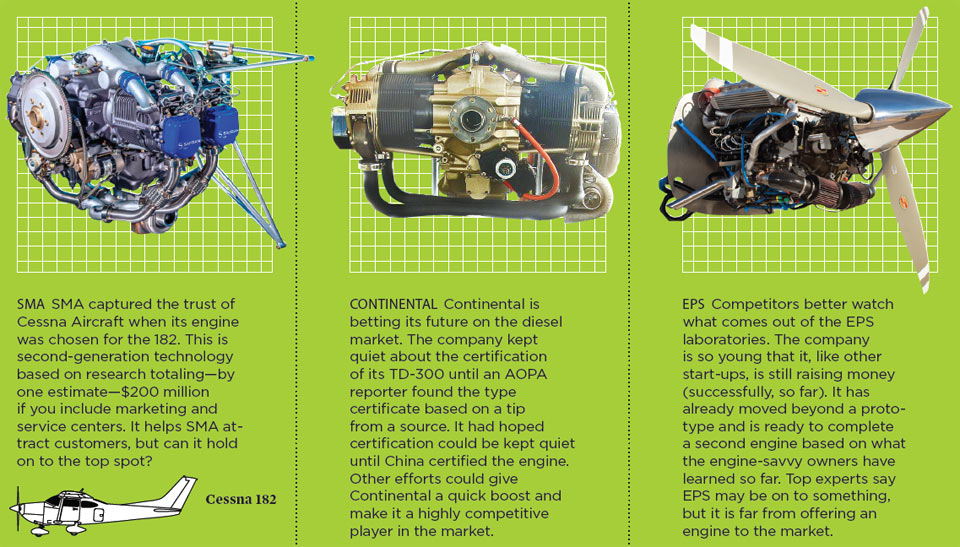

That Renault engine, through numerous management changes, has become the SMA engine that is now certified on the Cessna 182. As you’ll read in the second of our three-part series on advancements in propulsion, the SMA engine is joined by numerous other established and emerging options.

Next month, look for a package of stories on the role that electric propulsion may play in general aviation. As always, we welcome your feedback and observations on the subject via email, Facebook, and in response to our Reporting Points blog posts.

—Tom Haines, Editor in Chief

Does the rise of the Jet A-burning diesel aircraft engine signal an evolution or a revolution for today’s avgas-powered airplanes? Neither, according to a series of interviews with diesel-engine manufacturers and experts. It will take decades and is likely to take place only in heavy-use aircraft where fuel-sipping diesel engines make sense. American pilots may sit this one out.

Compression-ignition engines, as diesels are known, have little chance of dominating the American market, but the reverse is true in Europe, Latin America, Africa, and—ever so slowly—China. With a declining pilot population in the United States flying an aging piston fleet, manufacturers must look overseas for new customers. Most single-engine airplanes in the United States fly only 80 hours per year.

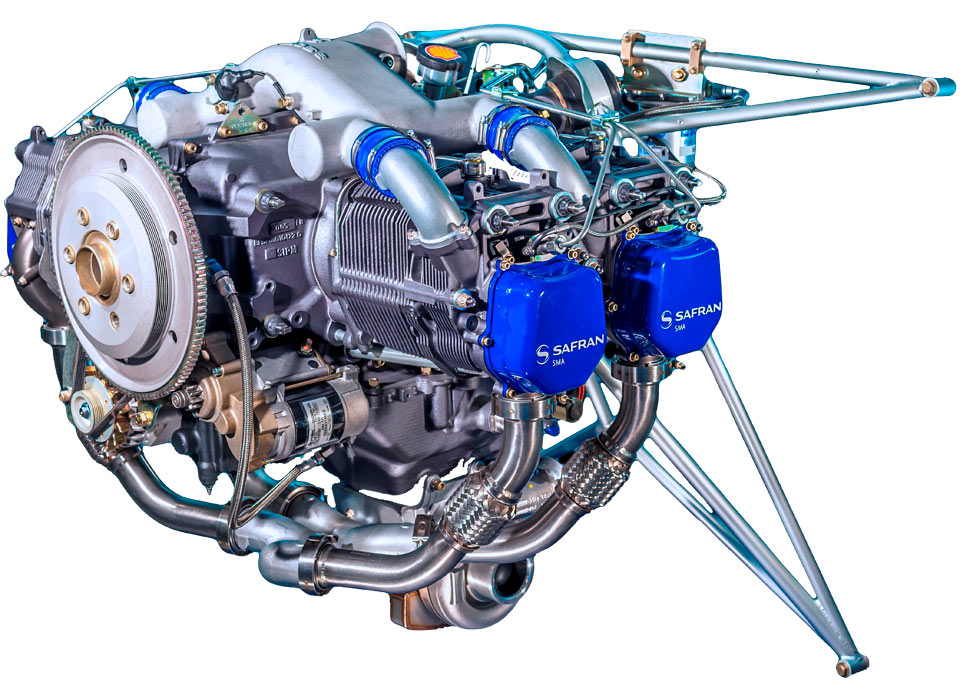

The switchover to diesel in the United States can be measured more at a geologic pace than with a stopwatch. For some, like missionaries in Africa where avgas can cost $18 to $22 a gallon, the switchover can’t come fast enough—Jet A there costs less than half that. In the United States, the difference between Jet A and avgas can be as little as 45 cents, but in Germany 100LL avgas was $12.68 a gallon while Jet A was $8.06. Diesel engines cost 30 percent more in purchase price than gas engines, so it takes a lot of flying hours to offset the initial cost. Diesel fuel savings are generally reported to be 25 to 30 percent compared to gasoline engines, and maintenance costs are lower, too.

André Teissier-duCros, until recently a consultant to SMA Engines in France and publisher of Diesel Air Newsletter at dieselair.com, offers this perspective. “When four nice old private pilots co-own a nice old Piper PA–28 and fly it in total 60 hours a year, they will keep it going as long as there is avgas available at any price, because any other way to go doesn’t make sense for such a flying time. On the contrary, a flight academy [that] operates an old fleet of post-1986 172s flying more than 600 hours a year may seriously consider converting the fleet to diesel.”

Strong predictions

Strong predictions

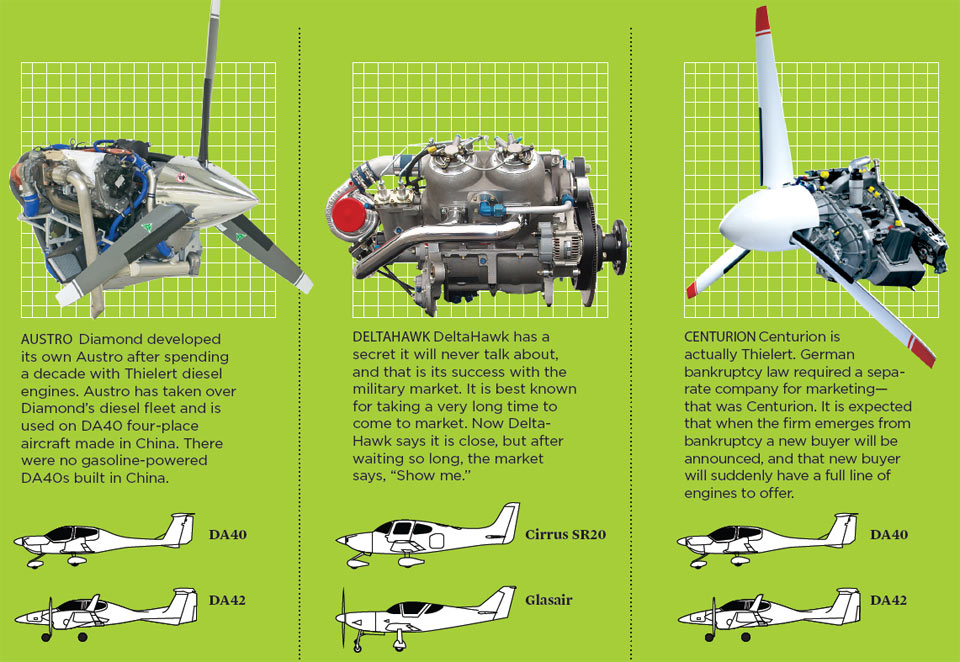

Austro Engines Marketing Director Peter Lietz offers a bright view of the future of diesel engines. He was asked if we all will be flying diesels one day. “I hope that the world will fly—all over the world—with diesel engines, but to be serious I expect that we will have a turnover in the next, let’s say, five to 10 years maybe—that we will have 60 or 70 percent of all general aviation flying with diesel or with alternative fuel,” Lietz said. Austro offers the AE300 (E4 series) four-cylinder, 170-horsepower, liquid-cooled engine found on Diamond aircraft (see “Not Your Father’s Aircraft,” page 50). (Diamond used Thielert engines on its DA40 and DA42 models.) It maintains 168 horsepower to between 9,000 and 12,000 feet.

Thierry Hurtes, chairman and CEO of SMA, said diesels will not replace

all gasoline-fueled engines, but will be used where it makes sense. He is currently developing the Cessna 182 market thanks to his contract with Cessna for the Cessna JT-A using second-generation SMA technology.

Another positive outlook comes from the spokesman for Thielert Aircraft Engines. Thielert has, in addition to the 135- and 155-horsepower Centurion engines, some 350-horsepower engines flying on several test airframes. The company has operated under insolvency proceedings since 2008 and did not spend much on development projects other than improving the existing series production engines. However, an investor process for Thielert is running and negotiations with potential buyers are under way. Asked the same question, this is how Sebastian Wentzler answered.

“Yes, we believe in the diesel way of flying. Jet fuel is available around the world, meaning availability in emerging markets. Smaller airports in the U.S. may not have it, but that’s a special situation for the United States. AOPA, GAMA, and [others] all say the main thing in the U.S. could be the loss of active pilots. That would lead to a stagnation of this most important regional market. Small airports in the United States are not the main target for the argument of jet fuel availability. But it is a strong argument for all future markets.”

Here’s how DeltaHawk’s President and CEO, Dennis Webb, answers when asked if we’ll all be going diesel.

“Are we all?—and the answer I think is no. Do we think they are going to [be] a huge part of general aviation worldwide? Absolutely. The lower-powered spectrum—the lower-powered market—is probably more towards the mogas. When you get down to 100 horsepower, it’s very difficult to scale down diesel technology to that level and still be weight- and size competitive.” DeltaHawk has a two-stroke, liquid-cooled engine that has been in development 20 years. Webb said this could be the year that it gets to market. The company has a 180-horsepower engine flying on a Cirrus SR20 and will also mount one on a Glasair Sportsman four-place aircraft.

Continental Motors is betting its future on diesel, while Lycoming has started five times to develop its own diesel engine, exhibiting one at Oshkosh, and stepped back from the diesel market all five times.

Continental Motors is betting its future on diesel, while Lycoming has started five times to develop its own diesel engine, exhibiting one at Oshkosh, and stepped back from the diesel market all five times.

Chinese-owned Continental (Aviation Industry Corporation of China, or AVIC) certified in December 2012 its 230-horsepower TD-300 diesel engine based on first-generation SMA technology but built from Continental parts. It is restricted to 12,500 feet on its type certificate, but that will quickly increase to a higher operating altitude with experience. The company plans, in addition to the TD-300, the TD-450 in the 300- to 350-horsepower range and the TD-220 in the 160-180 horsepower range. It may create those engines with acquired technology from other than SMA.

“Continental has said for several years that we are going to stake our future on diesel,” said Continental Motors President Rhett Ross. “We’re doing that because we’re looking at the international marketplace and the complexity of dual delivery structures [gas and diesel engines]. When you look at the history of the developing world, they tend to bypass things that the developed countries or regions of the world went through. An example would be landline phones. Cellphones as an infrastructure are a lot easier to install.”

Lycoming is not staking its future on diesel. Mike Kraft, senior vice president and general manager for Lycoming, said his firm has a contract with SMA to maintain engines such as the ones on the Cessna Skylane JT-A, but it will develop diesel engines only when the time is right.

“When the time is right means also that it is a correct business decision for us,” Kraft said. “We have developed aviation diesel engines and they’ve not been brought to the general aviation market largely because it was difficult for us to see a return on investment. Some of those projects date back to the 1970s.”

China is a booming market?

DuCros, the French diesel consultant, has this perspective on the Chinese market. He estimates China has about 1,000 gasoline-powered aircraft—mostly military.

“Building the complete infrastructure will take time. But Chinese enthusiasts have plenty of money, and then some, to learn to fly and buy a brand-new plane. As soon as it is possible, they will spend anything from $600,000 to $2 million to buy and fly their first plane. Later, of course, their business will buy a corporate jet and they will pilot no more. But the Chinese market will never reach anything like the U.S. market, which went through a unique history since 1918. Small Chinese planes will fly a lot, for business and convenience first. And yes, they will be diesels.

“So this conclusion: The TD-300 will sell in China. So will the 182 JT-A, the Diamonds, the Centurions, SMAs, DeltaHawks, and others. And then they will build experience.”

China has no airports designated for private use. It has no infrastructure to deliver avgas, and will probably bypass it all together. (One American working in China ordered aviation gasoline, waited for days while it was brought from afar by truck, and it was poor quality.) Deals were cut in 2007 with Diamond to build only diesel-engine DA40 aircraft—starting with Thielert engines and transitioning only now to Austro engines. The country recently opened less than one-third of its airspace to general aviation, and then only to 1,000 meters above sea level, not above ground level. Some of those interviewed for this article have suggested China is a 50-year project before its market booms, while others caution that the country has surprised us in the past.

Here’s how Lycoming’s Kraft assesses the Chinese market: “When Lycoming looks at China we look at them as a leapfrog technology country,” Kraft said. “They will probably leap right over fixed-wing, to some extent, to rotating [rotary] wing for a large portion of the fleet. Helicopters have the edge when you don’t have airfields. They will probably leap to business jet transport as opposed to the larger-cabin pistons.”

Diesels are malodorous

Flying clubs, one in Switzerland and one in Caldwell, New Jersey, have actual experience with SMA and Centurion (Thielert) diesel engines. In addition, the engine has proven a financial success for a missionary group operating in Niger. The SMA engine used by all three groups is a first-generation engine no longer made by SMA and no longer offered for retrofit. Here’s the New Jersey experience.

Fuel savings are so significant on the 230-horsepower SMA 305 diesel engine in one of the Paramus Flying Club’s Cessna 182s that it is offered at a lower rental fee. A gas-fueled 182 at the New Jersey club costs $191 an hour including fuel, while the diesel-powered 182 costs only $145 an hour. The gas engine burns 12 to 14 gallons per hour, says Paramus Flying Club President Chris Howitt, while the diesel is run at a low power setting and burns eight gallons per hour.

Howitt does admit the Jet A is “stinky,” as was apparent when a fuel valve leaked Jet A into the cockpit and soaked the carpet. “The only negatives about the SMA diesel engine are that the Jet A has a strong smell when refueling, and the belly of the aircraft needs to be cleaned more often than normal from the exhaust soot.”

The other club is Sweden’s oldest, Aeroklubben i Göteborg, which converted a 1998 Cessna 172R to the 155-horsepower Thielert engine, offering it to club members in January 2012. Here is the club’s experience as told by Andreas Martin and Lars Öberg in the Diesel Air online newsletter.

“Since then she has been flown by many of the club members without any major maintenance issues. Performance for takeoff, landing, and low-altitude cruise is very similar to the avgas-powered version. At higher altitudes it climbs better and has better cruise performance. It is operated on jet fuel and fuel consumption is approximately 35 percent lower than the petrol version. It is based on a field with a long asphalt runway but frequently flies to and from 600-meter (1,968-foot) grass runways with satisfactory margins. The plane has also been operated during the winter months including landing on the ice of local lakes.

“From January to December 2012 the plane has been flying approximately 200 hours. We had very few maintenance issues with the plane but see a few areas of improvement.

“From January to December 2012 the plane has been flying approximately 200 hours. We had very few maintenance issues with the plane but see a few areas of improvement.

“It takes a long time to get the engine warm enough to fly during the winter months. This was solved by installing an electrical heater which is run when the plane is in the hangar.

“The useful load is lower compared to the petrol version due to higher weight of the engine. This is partly compensated by having less fuel on board due to the much lower fuel consumption compared to the petrol version.

“Jet fuel smells. The tiny amount of remaining fuel in the drain cup leaves a definite smell of jet fuel in the cabin,” the Swedish pilots said.

Jim Rendel, a pilot and mechanic with the missionary organization SIM, said the group has two first-generation SMA diesel Cessna 182s operating in Niamey, Niger. Avgas is $22 a gallon and jet fuel in the area averages $7.50. The first arrived in 2007 and the second 182 recently arrived. Rendel expects the two airplanes will operate 400 hours a year each, which would amount to $200,000 in fuel savings per year.

Rendel said there were teething problems with the first-generation diesel, including alternator brackets, oil leaks from the engine-case halves, and a cracked exhaust that carried away a temperature sensor, requiring a landing and repair. Still, the aircraft flew 500 hours per year and one year flew 900 hours. What the group gave up by switching to the 182 was speed and the ability to carry stretchers, refrigerators, and 55-gallon drums.

Cessna’s got game

Early in testing of Cessna’s 182 JT-A aircraft, Editor in Chief Tom Haines found that the SMA second-generation engine used for flight testing took a long time to warm the oil enough for takeoff, and it was hard to slow during the approach to landing (“Jet A for Your Skylane,” October 2012 AOPA Pilot). The oil temperature issue turned out to be a faulty valve that was easily replaced. Pilots no longer need to slow to final approach speed early to avoid landing too far down the runway.

“The approach speed has been resolved,” said Project Engineer Brian Cozine. “Previously the engine had to carry extra power on descent so it would maintain enough heat, so you don’t have to worry about flameout on descent. The side effect was you couldn’t pull power back as much. That caused the airplane to float more than people are used to. We worked with SMA to reduce the lowest power [setting] and [now it] feels just like a gasoline-powered 182.”

The Skylane uses the 227-horsepower SMA SR305-230E-C1 engine that is 10 pounds heavier than its turbocharged, gasoline-powered counterpart. Deliveries were to have started by the time you read this.

Another concern in early generation diesel engines—restarting the engine at higher altitudes—also has been resolved. “We’ve restarted the engine to 20,000 feet numerous times during a battery of restart tests. Regardless of the altitude and conditions—if you turn off the fuel it will not stop spinning. Reintroduce fuel, and it fires right back up. While 20,000 feet is accessible [the expected certification altitude for the 182 JT-A], I don’t think that any of our operators will fly there; 10,000 to 13,000 feet is the sweet spot. Above that you don’t get much improvement in speed or in reduction in fuel flow. We find we get good speed of 155 knots and 11 gallons an hour between 10,000 and 12,000 feet,” Cozine said.

Cessna engineers are looking at diesel (Jet A) options for their 172 and 206 line of aircraft—but it must be a “mature” design that Cessna officials trust. “The future is probably very good for diesel engines up until you start getting into the 400- and 500-horsepower range, and then turbine engines start having the ability to produce that kind of power at substantially reduced weight,” said Engineering Test Pilot Charlie Wilcox. “Look at the economic advantages up until you get to that point, and it very highly leans towards diesel engines.”

Cessna engineers are looking at diesel (Jet A) options for their 172 and 206 line of aircraft—but it must be a “mature” design that Cessna officials trust. “The future is probably very good for diesel engines up until you start getting into the 400- and 500-horsepower range, and then turbine engines start having the ability to produce that kind of power at substantially reduced weight,” said Engineering Test Pilot Charlie Wilcox. “Look at the economic advantages up until you get to that point, and it very highly leans towards diesel engines.”

Which of the developing diesel technologies is best? Should the engine be aircooled or liquid-cooled? How many cylinders should it have? Is it best to keep costs lower by using car engines as the basis for development (Mercedes Benz or BMW), or go to a more expensive aviation design? (SMA’s first engine was designed by Bernard Dudot of Renault Sport, whose real fame comes from building turbocharged Formula 1 race car engines.) Those questions are unanswered. In the opinion of duCros, “None of the designs offered on the market today illustrate the aero diesel of the future.” That will take a few years.

Email [email protected]

Top diesel models

Competitors gather

These six engines are not the only diesel engines in development or entering the market, but they are the ones most talked about. Can some still in development emerge to knock existing leaders like SMA from the top spot? All the fledgling firms have one thing in common: they believe they can be the leader.