Honeywell’s yearly global business aviation forecast for 2014 is slightly more optimistic than the one issued last year, although operators say they plan to replace a slightly smaller portion of their fleet in the next five years. Strongest plans for purchase come from Europe and Brazil. As was the case last year, large-cabin jets account for nearly half the world fleet, although the percentage has dropped from 55 percent in the 2013 forecast to 46 percent in the 2014 Honeywell forecast.

Honeywell predicts up to 9,450 new business jets worth $280 billion will be delivered through 2024. Last year’s prediction was for 9,250 jets worth $250 billion through 2023. Purchase plans by the size of aircraft show 46 percent will be big cabin, 28 percent will be midsize jets, and 26 percent will be small cabin jets. The forecast is eagerly anticipated each year by the business jet industry and is announced at the National Business Aviation Association trade show taking place this year in Orlando.

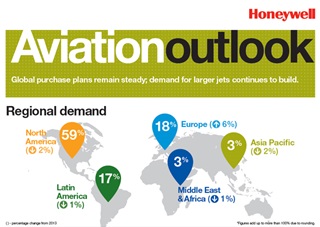

Highlights of the operator survey include a prediction that the value of forecasted deliveries has increased by 7 to 8 percent compared to 2013. Nineteen percent of the planned purchases are expected to be completed by the close of 2015. Fifty-nine percent of sales originate in North America.

“Honeywell forecasts 2014 deliveries of approximately 650 to 675 new jets, a single-digit increase in percentage growth year over year,” the report said. (The 2013 year-end report of the General Aviation Manufacturers Association indicates 678 business jets were shipped worldwide in 2013.) “The improvement in deliveries expected in 2014 is largely due to program schedule recoveries, new model introductions and additional fractional uptake.

“Another notable finding in the 2014 survey is the improved interest levels for midsize and small-cabin aircraft in operator purchase plans. While large-cabin models still garner the largest share of specific buying plans, the midsize and smaller models recovered some share for the first time in several years, reflecting improved prospects for popular production models as well as stronger interest in newer models just now available or soon to enter service,” the report said.

Other forecasters indicate jet industry sales both new and used have not yet healed from the recession of 2008, although Corporate Jet Investor suggested this past fall, based on indications from jet trade shows around the world, that it is time to drop “cautiously” from past reports that analysts are cautiously optimistic.

Joseph B. Nadol III of J.P. Morgan said in October, “We expect little change to the prevailing business jet narrative, which is that demand has stabilized but with only muted signs of recovery.” Nadol reported the used jet inventory has declined, the asking price of used jets is flat, and United States flight operations are up only 1.3 percent, after increasing at a steady four percent rate for 13 months. “Flight ops remain 16% below the Aug. 2007 level, so there is plenty of room for recovery as long as fundamentals do not break down,” Nadol reported.