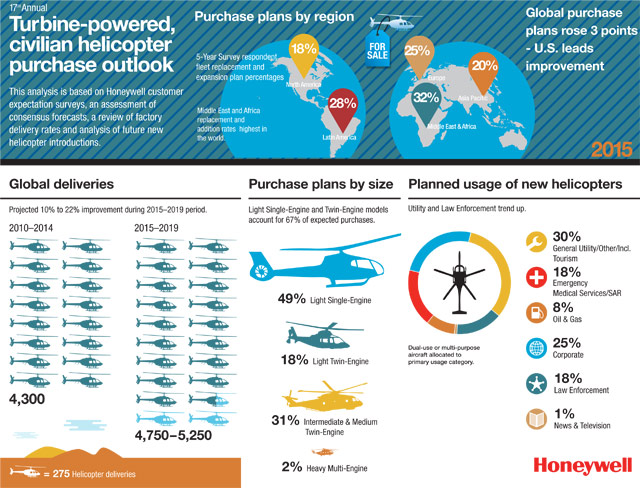

Despite a dramatic decline in 2014 helicopter deliveries, forecasters at Honeywell Aerospace project a steady stream of deliveries over the next five years. The company is forecasting the delivery of between 4,750 and 5,250 civilian turbine helicopters through 2019, a number described as “steady” compared to the 2014 forecast. That forecast predicted 4,800 to 5,500 helicopter deliveries through 2018.

Charles Park, director of market analysis at Honeywell, said short-term economic trends will impact delivery rates in the early years of the forecast period, but that improved years later in the forecast will return deliveries to 2013’s record highs.

Not surprisingly, fluctuating energy prices are impacting decisions by some companies, especially those involved in oil exploration, to lower their plans for future purchases. However, annual flight hour usage is forecast for significant growth in 2015 across most sectors, according to Park. Some 27 percent of North American users project increased fleet utilization in 2015. Forty-five percent of Latin America users are planning for growth. Europe, Middle East and Africa, and Asia-Oceania all project smaller increases.

Light single-engine helicopters represent nearly half of all planned purchases during the forecast period; light twins command 18 percent of the market; intermediate and medium twins are at 31 percent. Just 2 percent of the market goes to heavy multiengine platforms.

Emergency medical services, law enforcement, tourism, and training are market sectors projecting growth through 2019.

Especially in the North American market, the forecast shows a shifting preference toward light singles, away from heavier equipment. Meanwhile, the BRIC countries (Brazil, Russia, India, and China), which showed great promise a few years ago, show “ebb and flow” in the coming years because of changing economic climates. Projections for India are up while Brazilian and Chinese purchase rates slipped moderately, according to the survey results. However, in both cases, helicopter purchase rates still exceed the world average, according to Honeywell.

Park said the survey did not ask about companies’ plans to purchase unmanned aircraft systems for future applications, so he was not able to predict the impact of the FAA’s recent notice of proposed rulemaking allowing the use of small UAS for certain commercial operations. Park suggested that future surveys will include questions to address that market.