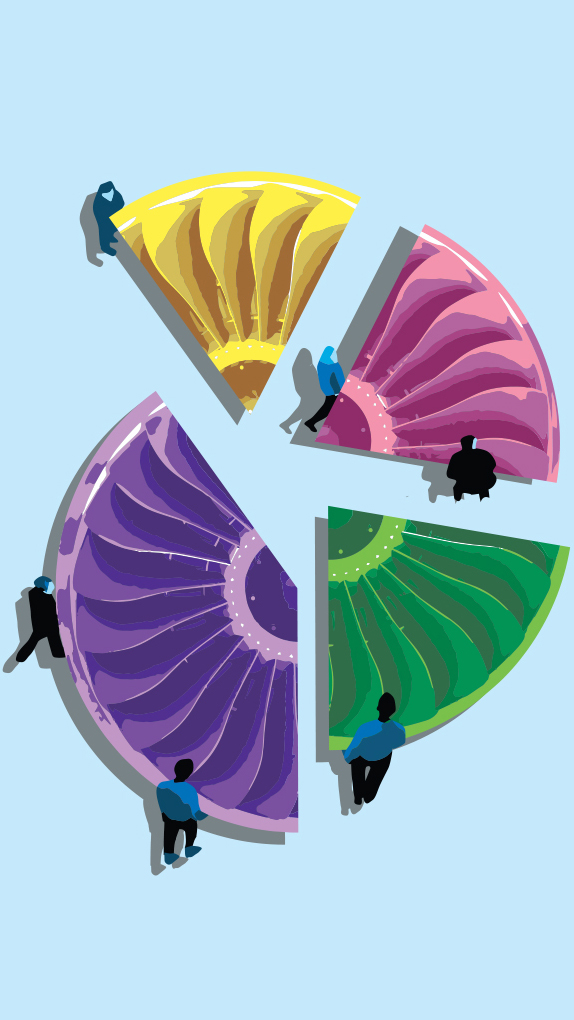

A piece of the pie

A look at shared ownership options

By Nel Stubbs

There are numerous options for operating your aircraft, ranging from leasing, chartering, and sharing to full ownership. The primary drivers behind these alternative arrangements are the acquisition costs, operating costs, and the legal and tax considerations. This article will focus on the shared aircraft ownership options—how they are the same and how they differ.

JOINT OWNERSHIP

JOINT OWNERSHIP

First and easiest to describe is “joint ownership.” Joint ownership is defined under FAR 91.501(c)(3) as “an arrangement whereby one of the registered joint owners of an airplane employs and furnishes the flight crew for that airplane and each of the registered joint owners pays a share of the charge specified in the agreement.” The FAA has not established a minimum percentage of ownership; however, the relationship must be a true joint ownership and not just a token ownership interest.

The IRS has also determined that a joint ownership agreement, if executed correctly, is noncommercial for tax purposes. This is based on the fact that each of the co-tenants, or registered joint owners, pays their pro rata share of all fixed costs attributable to the aircraft and also pays the direct operating costs when they are on board their aircraft.

In addition, each of the co-tenants maintains considerable control over the pilots. This includes the ability to hire a pilot other than the ones employed by a joint owner. Also, pilots are under the co-tenant’s exclusive control, subject to the discretion of the pilots as to safety issues. Under this arrangement, the IRS has determined that the amounts paid by the co-tenants for costs associated with the use of their aircraft will not be considered amounts paid for the use of someone else’s aircraft.

FRACTIONAL OWNERSHIP

Fractional ownership, under FAR 91 Subpart K, is a concept where registered co-owners of an aircraft employ a management company and allow the management company to dry lease exchange the aircraft among their fleet. When owners purchase an interest in an aircraft, it guarantees the owner a set number of hours of flight time per year. Under this arrangement, the management company establishes the suitability requirements for the pilots and, in most instances, supplies pilots and pays their salaries. The owner can provide his or her own pilots, however, with 24 hours’ notice.

If an aircraft in which an owner has an interest is not available for the owner’s use at a particular time, under the dry lease exchange agreement, the management company will provide another aircraft from the program. Under the management agreement, if there are no program aircraft available, the management company will provide an aircraft from its charter fleet.

OTHER FORMS OF SHARED OWNERSHIP

Co-ownership is very similar to joint ownership. However, instead of one of the owners operating the aircraft for all of the owners, each of the owners is responsible for employing their own pilots. Usually, in the case of co-ownership, the respective owners will independently fly the aircraft themselves, hire a pilot, or hire a management company to not only fly the aircraft but also maintain the aircraft.

Another form of co-ownership is where the owners of the aircraft create an entity to be the registered owner of the aircraft and each of the “owners” is a member or shareholder in this entity. The difference here is that the entity that was created to purchase the aircraft cannot have operational control of the aircraft, and therefore cannot pay the pilot(s). Rather, there needs to be a dry lease from the entity to each of the members or shareholders for their use of the aircraft and each of them would hire/pay for the crew, much like the traditional co-ownership arrangement.

Joint ownership, shared ownership, and fractional ownership can all be Part 91 operations, and not subject to the commercial federal excise tax when executed correctly. It is in everyone’s best interest to understand how these options differ and which one you or your client is truly interested in. It will affect the application of federal and state taxes on the aircraft, and how the FAA looks at the operation.

Nel Stubbs is vice president and corporate secretary for aviation consulting firm Conklin & de Decker.