A decade after the Learjet 85 was announced, the long-delayed program was put on “pause,” Bombardier Inc. announced Jan. 15, simultaneously disclosing that 1,000 workers would be laid off, and the company would book a $1.4 billion loss, a figure representing the long-struggling program’s development costs.

Company President and CEO Pierre Beaudoin told Aviation Week that the company has ruled out terminating the program.

"When we say ‘pause,’ we mean ‘pause,’" Beaudoin said, adding that the fastest and lightest Learjet to date still has a future. "It’s already been flying. We think we can complete this aircraft when the market is right.”

Bombardier attributed the decision to market weakness, and two other programs in development: the CSeries narrow-body airliner, and the Global 7000 and 8000 ultra-long-range business jets.

Aviation analyst Richard Aboulafia of the Teal Group in Fairfax, Virginia, isn’t buying that.

“The idea that this is just paused while writing off a billion point four dollars and laying off a thousand people asks people to believe they are foolish,” Aboulafia said, adding it would be equally foolish to accept the explanation at face value. “They’re just desperate to get away from the impression that they’re running out of cash for the CSeries program.”

The market reacted negatively to the news, with Bombardier stock dropping more than 20 percent in the first 24 hours, the largest such drop in more than a quarter-century, according to Bloomberg.

Beaudoin said in a news release that factories in Wichita, Kansas, and Querétaro, Mexico, where the job cuts are being made, will continue to build other aircraft, including the Learjet 70 and 75 models being assembled in Wichita.

“Given the weakness of the market, we made the difficult decision to pause the Learjet 85 program at this time,” Beaudoin said in a news release. “We will focus our resources on our two other clean-sheet aircraft programs under development, CSeries and Global 7000/8000, for which we see tremendous market potential. Both programs are progressing well.”

Aboulafia said Bombardier’s claim that market weakness was a factor in the decision does not ring true, in part because the market is actually trending upward (evidenced in part by the latest industry report from the General Aviation Manufacturers Association).

Aboulafia said it also makes little sense to decide the fate of a production run that should last decades based on the market of the moment, and undermining the strength of the market with negative assessments cannot help matters.

“Not only did they tell the market that they were in a weak position, they also tried telling the market that the market was in a weak position,” Aboulafia said. “That’s about as foolish as it gets.”

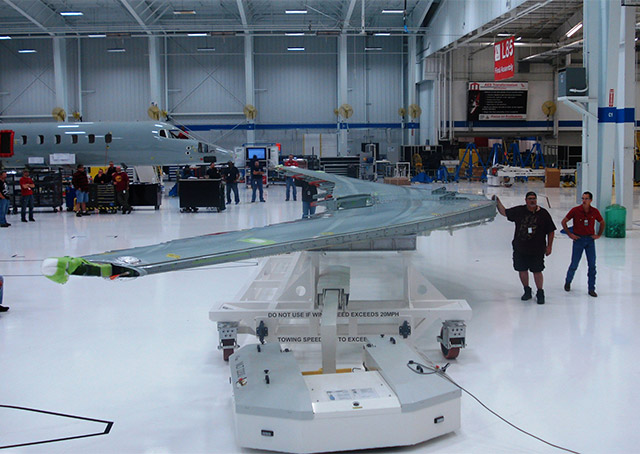

Only one all-composite Learjet 85 has been built to date, a test aircraft that made its public debut at the National Business Aviation Association convention in October. The $21 million, 470-knot jet with a 3,000-mile range was expected to compete with offerings from Embraer and Cessna, among others.

“Bombardier’s biggest enemy has always been Embraer, and yet Bombardier’s management team appears to be working for Embraer, very hard,” Aboulafia said, noting Embraer should expect to sell more Legacy 500s in the Learjet 85’s absence; Cessna to a lesser degree, also stands to gain market share, Aboulafia said.

The long-term ramifications for Bombardier could be more serious. Aboulafia noted that executives have left “in droves” in the past year because of CSeries problems, and the loss of talent could impact the development of future aircraft that Bombardier would need to compete in the long term.

“They’re being forced into a position where they need to eat their seed corn, and that’s never a good place to be,” Aboulafia said.