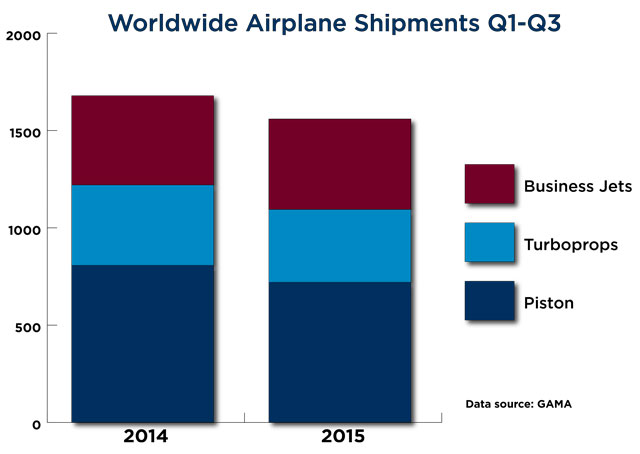

General aviation aircraft makers are bouncing back from a terrible first quarter, when double-digit declines hit the piston, turboprop, and jet sectors. The latest data released Nov. 6 by the General Aviation Manufacturers Association showed signs of recovery toward 2014 sales volume, but piston and turboprop sales continued to lag.

Overall, airplane makers posted a 6.5-percent decline in aircraft shipments and a 1.5-percent increase in total billing for the first nine months of 2015 compared to the same period in 2014. The relative strength of the business jet market offset declines of 11 percent in piston shipments and a 9.4-percent drop in turboprop shipments. (There’s an asterisk attached to the third-quarter data from GAMA: It excludes jet sales by Dassault Aviation, which reports data twice each year in accordance with company financial reporting procedures. GAMA excluded third-quarter totals from Dassault for both 2014 and 2015; there was no data on piston sales from Flight Design in the Nov. 6 report, either.)

While the business jet market appears to be returning to the 2014 pace, there were many soft spots in the overall report. Specialty airplane makers serving the agricultural market including Air Tractor and Thrush Aircraft posted large declines for the first three quarters, with shipments off by 27 percent for Air Tractor and 32 percent for Thrush. Aviation analyst Brian Foley said weakness in overseas markets is the likely culprit, though GAMA President and CEO Pete Bunce attributed the losses specifically to the ongoing political impasse over the U.S. Export-Import Bank, which shut down in the summer after Congress failed to reauthorize it for the first time since the bank was created to facilitate large international transactions in 1934.

“In the turboprop market our agricultural aircraft sector has been particularly hard hit by the U.S. Export-Import Bank’s inability to make new financing guarantees since July 1. Therefore, we are very encouraged by the strong bipartisan support in the U.S. House of Representatives this month that complements U.S. Senate support in late summer to renew the Ex-Im Bank,” Bunce said in a press release Nov. 6. “We are hopeful that the Surface Transportation bill to which Ex-Im re-authorization is attached will be conferenced quickly and sent to the President's desk for his signature. We also hope Congress will move quickly to extend critical tax policies, providing greater certainty to the market going forward.”

The Ex-Im impasse has been a hot topic in Wichita, Kansas, this year, though Foley said its dormancy probably doesn’t explain the overall slowdown in turboprops.

“That’s normally a game for airliners and very high-end bizjets,” Foley wrote in an email. He said the decline in turboprop sales overall can also be partly attributed to Textron Aviation completing the acquisition of Beechcraft in 2014, “which likely resulted in a slug of King Airs being delivered, temporarily driving up the overall 2014 turboprop deliveries. 2015 is likely more normalized for (Textron).”

The Ex-Im controversy may not explain the piston declines at all. That market is dominated by Cirrus Aircraft, with sales that account for 41.5 percent of worldwide piston airplane deliveries for the first nine months of 2015. That market share is up from 26 percent of world piston sales in the same months of 2014. Cirrus still saw deliveries dip by nearly 4 percent year over year, but the company’s estimated billing increased by about the same percentage.

Cessna Aircraft posted a 17.65-percent gain in piston model sales, and was the only manufacturer gaining significant ground in piston aircraft. Part of that was due to resumption of sales of the Skylane models. The company confirmed in May that it had stopped taking orders for the Cessna 182 JT-A diesel version, and listed eight avgas-powered 182s in the third-quarter totals reported to GAMA.

Textron Aviation announced Nov. 9 that the TTx has been certified in Australia, expanding the market for a model built for speed that accounts for about 10 percent of Cessna piston sales.

Beechcraft Bonanza and Baron sales, meanwhile, were down 30 percent (combined) for the first three quarters.

Foley said uncertainty over the future of avgas and its potential replacements may help explain the overall piston slump.

“Piston buyers could still be spooked by the leaded avgas controversy and future availability, while a plentiful supply of pre-owned inventory makes them question the value of that new airplane smell,” Foley said.

Piper Aircraft, meanwhile, suffered the largest percentage decline in piston airplane sales, down 51 percent for the first three quarters of 2015, with 29 piston Pipers shipped this year so far, compared to 59 for the same period in 2014. Piper hasn’t logged the sale of a new Warrior III since shipping three in the third quarter of 2014, the only three sold that year. Sales of the Archer III dropped from 30 to 12 for the first three quarters, year over year.

Data from past years shows that the fourth quarter is often the strongest in all sectors.

“By the end of this year it’s still conceivable that deliveries across all categories could still be relatively comparable to 2014,” Foley said.