Honeywell finds business aviation looking up

Annual forecast predicts speedy recovery

Honeywell expects business jet flight hours for 2021 will surpass the 2019 total hours flown before the coronavirus pandemic, among several signs pointing to recovery and long-term growth.

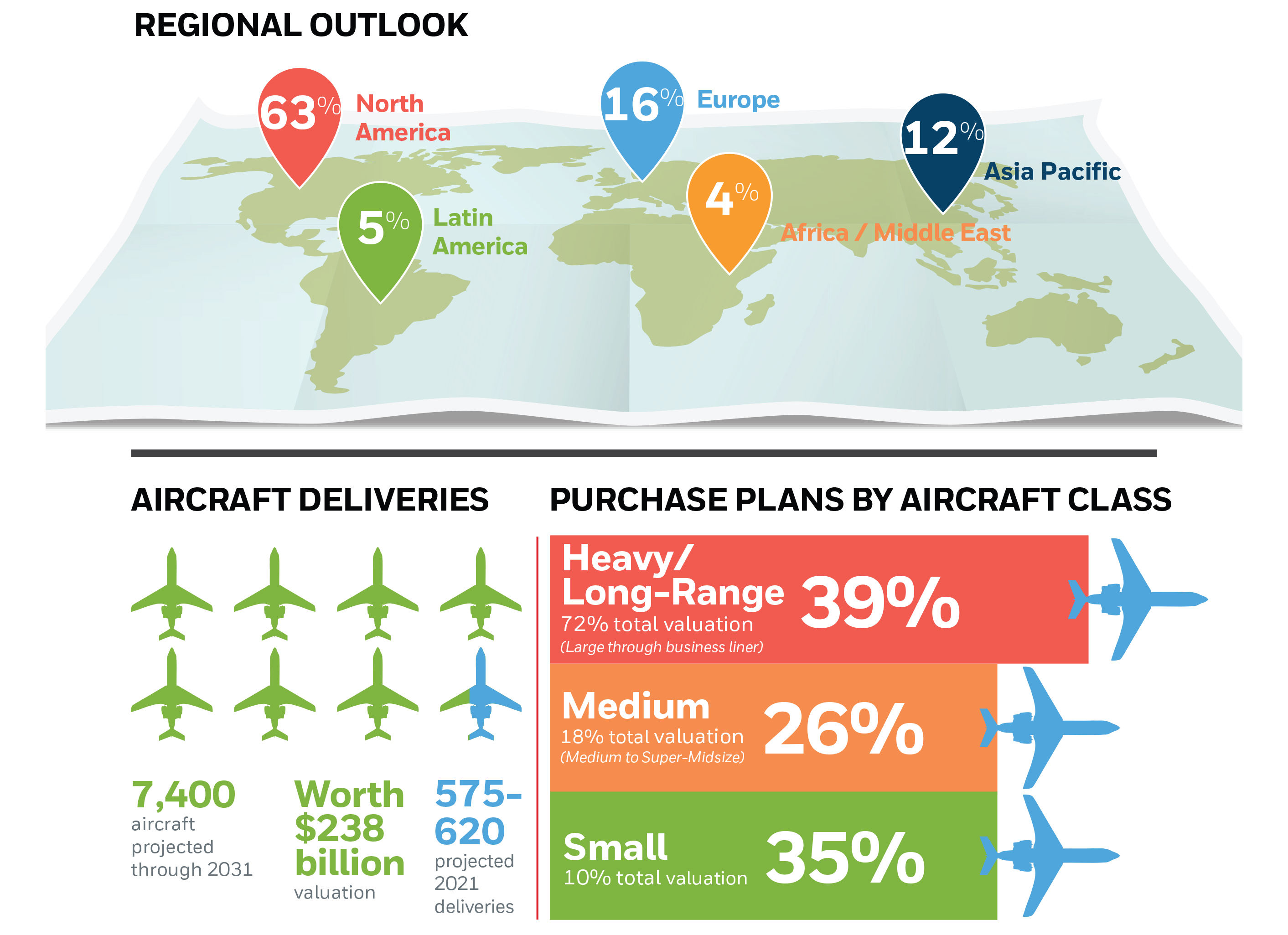

The foundation of the optimism in Honeywell's thirtieth Global Business Aviation Outlook is an annual survey of business jet operators, production and development information shared with Honeywell by aircraft manufacturers, and other economic data. While COVID-19 has had devastating effects on travel and tourism, and the air transport industry writ large, business aviation is already showing signs of a strong rebound: Honeywell expects business jet deliveries will increase 10 percent in 2022 compared to 2021 in terms of units billed, with 3 percent annual average growth in deliveries to follow through 2031. The new forecast calls for 7,400 new jet deliveries (with a total value of $238 billion) between 2022 and 2031, an increase of 1 percent compared to Honeywell's 2020 forecast.

"The increased demand for used jets is estimated at more than 6,500 units over the next five years, putting pressure on an already record low inventory and driving additional demand for new jets," said Honeywell Aerospace Americas Aftermarket President Heath Patrick, in the October 10 forecast announcement. "Our latest operator survey results support continued private jet usage growth, as more than 65 [percent] of respondents anticipate increased business jet usage in 2022. Despite the ongoing challenges presented by the pandemic, flight hours have recovered and grown beyond pre-pandemic levels. The overall health of the business jet market is strong, and growth is expected to continue."

A few clouds remain over an otherwise sunny outlook, particularly for the near term. Survey responses indicating plans to purchase new business jets in the next five years were down two percentage points from the 2020 survey, which Honeywell attributed to uncertainty provoked by the rise of the COVID-19 delta variant, which was much in the news when the survey was underway. Honeywell expects that will be largely offset by demand for used jets in the face of record-low inventory that "will inevitably drive additional demand for new-build business jets."

Aircraft use, another key metric, has increased and is on pace to end the year with a nearly 50-percent increase in flight hours compared to 2020, and about 5 percent higher than 2019. About two-thirds of current operators expect to log more hours in 2022 than in 2021. Also, the number of respondents planning to sell one or more aircraft in the next five years without replacing them dropped from 10 percent in 2020 to 4 percent this year, Honeywell noted.

Honeywell's forecast also helps explain why manufacturers continue to dial up the range and size of business jets, including Gulfstream's unveiling of the G400 and G800 models just ahead of the National Business Aviation Association’s Business Aviation Convention and Exhibition. Interest in the biggest, fastest, and longest-range options available continued to increase, with large-cabin and high-speed, ultralong-range jets expected to account for 72 percent of all spending on new jets in the coming five years.