Still cautious, still optimistic

Aircraft industry may see boost in 2014

Six months after the stock market crash of 1929, President Herbert Hoover told the U.S. Chamber of Commerce that the economy was turning a corner: “I am convinced we have now passed the worst and with continued unity of effort we shall rapidly recover.”

Hoover has often since been misquoted as saying, “prosperity is just around the corner,” which amounts to the same basic message. It was a badly mistaken notion, and no one in the general aviation industry has been guilty of such hubris since the global collapse of 2008 (the aviation downturn is older still, now nearly a six-year struggle). Instead, aviation industry analysts like Richard Aboulafia of the Fairfax, Va.-based Teal Group use phrases like “cautiously optimistic.” Over and over again, from one year to the next.

“It’s a bit like Groundhog Day,” Aboulafia conceded in a telephone interview about the state of the GA industry in 2013, referring to the 1993 film in which Bill Murray plays a weatherman who relives the same day, over and over again, for nearly the entire film.

“What’s more frustrating is to look at the leading macroeconomic indicators. That’s almost painful,” Aboulafia said. “There’s a big disconnect between what we should be doing and what we actually are doing.”

Companies are making money, and the number of high-net-worth individuals is increasing. “It’s all good news—it just doesn’t seem to be translating down to bizav,” Aboulafia said.

That is not to say things are tough all over. Sales of high-end business jets, such as Gulfstream’s G650, have made up for losses in other segments. As The New York Times noted Dec. 16, the top-of-the-line segment has grown for the past five years.

“It’s hardly organic,” Aboulafia said. Though still sluggish, the mid-sized business jets, pistons, and turboprops are nonethless showing signs of life. Aboulafia said his “cautious” optimism is founded by those positive indicators—along with the recent passage of a federal budget, the first in years, which may boost confidence in the economy as a whole and can be expected to inspire confidence among potential buyers.

“They’re all primed for some kind of an uptick,” Aboulafia said of aircraft manufacturers. “You’re seeing progress in most categories.”

Signs of recovery

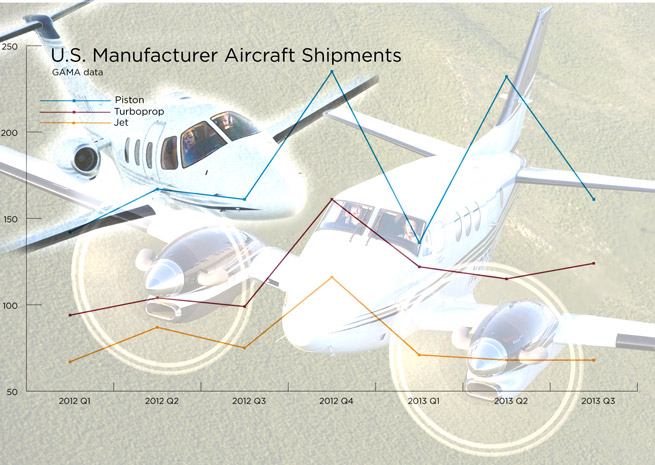

Brian Foley of Brian Foley Associates in Sparta, N.J., said the third-quarter numbers from the General Aviation Manufacturers Association—still the most recent data available until the year-end reports are issued in early 2014—made him more optimistic than some. Foley was particularly encouraged by the uptick in piston and turboprop deliveries, which are a more immediate indicator of demand than the larger jets, given the long delay between signing a contract and taking delivery of, for example, a $60 million aircraft. Sales of pistons and turboprops, Foley noted, are almost instant in comparison.

“I’m glad to see that end of the market starting to pick up,” Foley said of airplanes with propellers. “It tells me in more real-time that there’s good changes out there.”

Cessna Aircraft Co. touted the coming new jets (including the Latitude and Longitude), and its high-end piston TTx (which retails for $733,950) at the National Business Aviation Association Convention in October. At the same time, the company dismissed questions about a test flight engine failure of the diesel-powered Cessna 182 JT-A, reporting only that certification of that aircraft is ongoing. The light sport Skycatcher, on the other hand, wound up behind the woodshed in 2013 (the two-seater has “no future,” according to the company CEO), with dozens of unfinished aircraft still in inventory. Soft sales in the small and mid-size business jet market contributed to Cessna’s $23 million third-quarter loss, though deliveries of the new Citation M2 and Sovereign, followed by the Citation X expected in early 2014, may help Cessna turn that tide.

Aboulafia said Cessna’s affinity for big-ticket aircraft makes perfect sense.

“From Cessna’s standpoint, the top half of the market didn’t suffer, the bottom half got clobbered. The rest is details,” Aboulafia said.

Beechcraft Corp. made news late in the year, when Textron, the parent company of Cessna Aircraft and Bell Helicopter, purchased the company for $1.4 billion. Beechcraft had emerged from bankruptcy in January and shut down jet production entirely.

A company spokesman noted in an email exchange that a $1.4 billion deal with Wheels Up for delivery of 105 King Air 350i aircraft—a figure that includes ongoing maintenance support—was a major boost, and the company plans to increase spending on product development by 300 percent compared to recent years. Beechcraft also continues to gather customer input about making a single-engine turboprop.

Aboulafia has not changed his original assessment that the sale of the Hawker jet lines (the company confirmed by email that the sale of the Premier and Hawker 4000 assets is expected soon) has rendered Beechcraft a “niche” company, with long-term survival an open question.

“This was not a strategy, though, it was a necessity,” Aboulafia said, adding he will be surprised if a buyer takes on anything more than the after-market support of the jet lines. As for continued development and production, “the risk-to-reward ratio is turned all wrong.”

‘A turnaround year’

There remain bright spots in the piston and turboprop market. Agricultural aircraft, in particular—cropdusters are selling like gangbusters, driven by demand for increased food production worldwide, with no signs of letting up.

Cirrus Aircraft has likewise done well with its Generation 5 SR22 models, posting $125.5 million in sales through the first three quarters of 2013, compared to $90.8 million for the same period in 2012. Matt Bergwall, the company’s product marketing manager, said the year has finished strong, and the current backlog of SR-series orders is approaching an all-time high.

“It’s been a good year for us, and it feels like a turnaround year,” Bergwall said. “It really feels like those headwinds are starting to turn into tailwinds.”

Foley said opinions are mixed when it comes to the Cirrus Vision SF50 jet. Cirrus expects the first conforming model to fly in a matter of months.

“There’s a camp that says that’s the next great thing, we’ll darken the skies with those,” Foley said. “There’s others that might argue that maybe Cirrus should stick to their knitting and make the best piston aircraft.”

Aboulafia said he’s in the latter camp.

“Most likely it’s just going to drag cash away from your core business,” Aboulafia said. “Just because the Chinese play a role doesn’t mean you’ve won the lottery.”

Bergwall said the SF50 program is separated from the company’s core business, with a dedicated staff and dedicated funding.

“One thing we do have is over 500 positions (deposits),” Bergwall said of the new jet. “So for us, that’s a pretty good indication that there is definitely a market there.”

Easing headwinds

Piper Aircraft, another mainstay of the piston and turboprop markets, has been steadily making its numbers, buoyed in large part by a succession of fleet deals for training aircraft, along with demand for higher-end pistons and turboprops. The company has also beefed up its global sales force, and celebrated steady gains—along with concern about the government shutdown’s potential impact—in November.

The long-running cycle of federal fiscal impasse has been ended, at least for a couple of years, with passage of a federal budget. Aboulafia said that budget deal, much more than the Small Airplane Revitalization Act (which imposes a 2015 deadline for the FAA to overhaul of Part 23 to simplify and cut the cost of certification), is likely to boost sales as a major source of uncertainty is removed from the equation. Foley noted that the decision by the Federal Reserve to ease stimulus is likely to prompt long-stagnant interest rates to begin to rise, and since most aircraft purchases are financed, buyers may be motivated to add fuel in 2014 to an industry engine long running lean.

“That might have an effect of getting some people off the fence,” Foley said.